What does the new Florida Amazon Warehouse mean for FBA Sellers?

by November 1, 2020

Have you heard? Amazon is now having FBA sellers ship to a new fulfillment center in Florida.

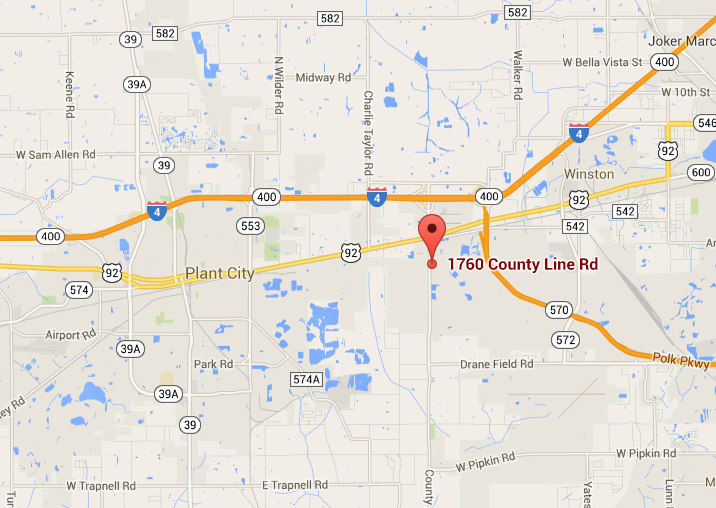

Word just recently came to us through our Sales Tax for eCommerce Facebook group that sellers are now being asked to ship to:

#TPA2

1760 County Line Rd.

Lakeland, Florida 33811

Polk County

What does an Amazon Fulfillment Center opening in a new state mean for online sellers?

Sales Tax Nexus in Florida

If Amazon asks you to store your goods to the new Amazon Fulfillment Center in Lakeland, you will then have sales tax nexus (i.e. significant physical presence) in Florida.

This means you are now responsible for collecting sales tax from your customers in Florida.

To get started, first register for a Florida sales tax permit. If you don’t do this and collect sales tax from Florida customers, you may be considered in violation of Florida laws.

If you have questions about collecting sales tax in Florida, check out our Florida Sales Tax for Online Sellers blog post for a lot more info.

From there, make sure you are collecting sales tax from your Amazon buyers in Florida and on all other channels. Here’s a step-by-step video guide to setting up sales tax collection on Amazon:

Other Florida Amazon Warehouse Considerations

Even if Amazon doesn’t directly ask you to ship goods to Florida, they might transfer your products there. Check here for how to find out where Amazon stores your goods.

Have you been asked to ship to a fulfillment center in Florida? We are trying to keep a comprehensive list of Florida’s fulfillment centers as they open up. Please share any addresses you are asked to ship to in the comments. Thanks!