Michigan Passes New Sales Tax Nexus Law

by January 12, 2015

It’s no secret that states are hard up for cash. And now some states are taking active measures to do something about that cash crunch.

Both houses of the Michigan legislature just passed a law designed to bring in more revenue from sales and use tax.

When signed into law by the governor of Michigan, Enrolled Senate Bill No. 658 will cement the definition of “sales tax nexus” and require some companies that don’t currently have a physical presence in Michigan to collect sales tax from customers via internet sales.

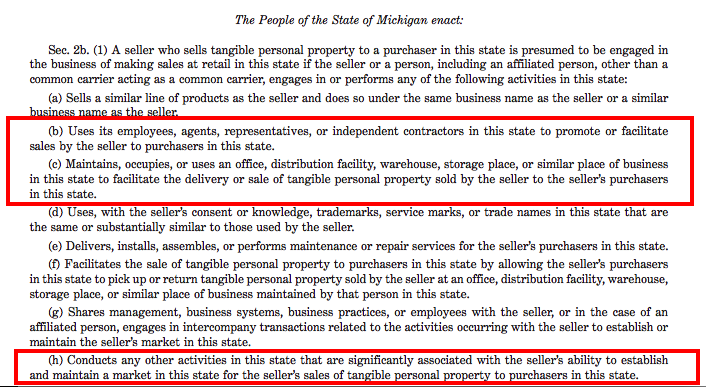

The bill spells out which activities constitute sales tax nexus:

Note that this bill clarifies that storing goods in a warehouse, or contracting with installers or repair people will now specifically constitute sales tax nexus with Michigan.

The state Treasury Department estimates $445 million in sales and use tax revenue from remote purchases will go uncollected this fiscal year, nearly two-thirds of it from e-commerce. The Michigan Senate Fiscal Agency estimated that the bills could generate around $50 million a year from Amazon, Overstock, eBay and other Internet retailers by clarifying just exactly what constitutes nexus.

What does Michigan’s new sales tax nexus law mean for online sellers?

If you don’t currently have any business ties to Michigan, then this bill doesn’t affect you. This is not to be confused with “Internet sales tax,” which are attempts by the federal government to pass laws requiring Internet sellers without sales tax nexus in a state to charge sales tax.

But if you do have business ties in Michigan – such as an employee, storing products in a warehouse, or even a 3rd party affiliate – then pay attention. While Michigan’s Department of Revenue hasn’t specifically stated how they plan to enforce sales tax collection on sellers outside the state, the specifics of this bill make it clear that they will be taking a hard look at online sellers doing business in the state.

While this bill has not been signed into law yet, it was put before Michigan governor Rick Snyder on January 6, and he has already said that he will sign the bill. In that case, we can expect this law to go into effect in October 2015.

Update: This bill was signed into law on January 19, 2015.

Find out more about sales tax in Michigan here.