TaxJar AutoFilers: How to File Washington Business and Occupation Tax

by June 19, 2017

Updated: TaxJar now automatically files your Washington B&O tax as part of your TaxJar AutoFile for no extra fee.

TaxJar’s AutoFile service for Washington State makes use of their Individual Streamlined Return (ISR) format to file and remit payment to the state. While this process does handle your sales and use tax liability to the state, this blog post is for Washington filers who choose not to have TaxJar also handle your Washington Business and Occupation (B&O) tax filing.

Follow these steps to ensure that you pay your B&O tax payment on time and without common errors, such as double payment.

All Washington businesses must file a Business and Occupation tax return. Part of that return includes reporting retail sales for sales and use tax. You will need to report the total taxable sales for this part of the return. However, to ensure you don’t get charged double, you only need to enter the retail sales amount submitted via TaxJar as a deduction.

Simply follow the steps below:

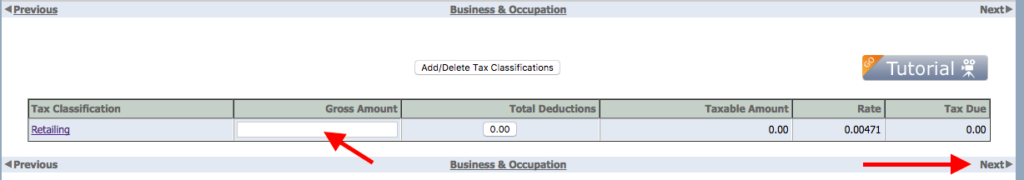

Step 1: Enter your retail sales for the period on the screen for Business and Occupation tax. Then click next.

Step 2: Enter your Gross Retail Sales amount on the State Sales and Use screen. Then click the button under the Total Deductions column.

Step 3: Scroll down to the second to last deduction line item, called “Retail Sales Tax Reported on ISR,” and enter the gross retail sales that was reported by TaxJar.

This amount should be the same as you entered in the previous screen for Gross Retail sales.

Why should I use AutoFile if I still have to file a Business and Occupation tax return?

In short, because it will likely save you up to an hour of data entry. The most time-consuming part of the B&O return is the sales and use tax local jurisdictions, which can number in the dozens. TaxJar’s AutoFile sends all of that detailed information directly to the state, so you only need to enter the total taxable sales. If you’d rather not take our word for it, we invite you to fill out the detailed local jurisdiction section and see. We honestly want customers to feel like they get a tremendous value from AutoFile.

If you ever decide that you’d like TaxJar to take over filing your full Business & Occupation tax return, simply visit your TaxJar AutoFile page, select “edit” next to the state of Washington, and check the box saying you want to have us file your B&O return.

Have questions or comments? Send us an email at [email protected].