Seamless tax compliance for online retailers

Simplify US sales tax compliance for all your sales channels with automation that works wherever you sell.

Simplify US sales tax compliance for all your sales channels with automation that works wherever you sell.

No matter what you sell, a miscategorized product can create compliance issues. Staying compliant with evolving tax laws and rates nationwide is a time-consuming task. TaxJar continually monitors these changes and offers comprehensive product tax content, ensuring accurate rates for all sales.

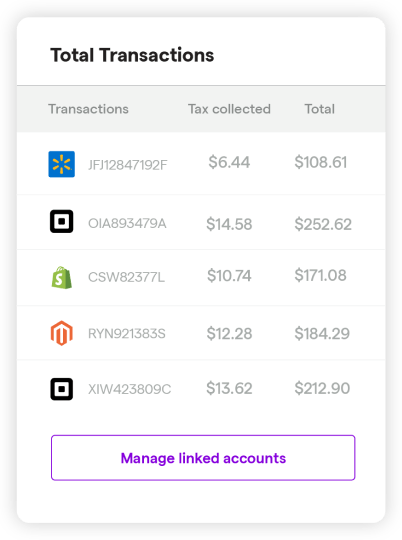

Easily connect sales channels and systems to TaxJar through our e-commerce, ERP, marketplace, and shopping cart integrations. For unique needs, create a custom integration.

See the full list of TaxJar integrations

E-commerce is predicted to account for nearly 40% of global retail sales by 2026, outpacing in-store retail growth.

Source: Future of Digital Shelf Report

Customers expect to buy in more places than ever, through multiple sales channels. Maintaining an integrated customer experience during peak seasons like Black Friday or Cyber Monday is challenging, especially when selling into more states. TaxJar’s fast, reliable API and sales tax engine ensure accurate rates, no checkout delays, and economic nexus compliance.

TaxJar simplifies sales tax compliance every step of the way. Here’s how our platform works:

Prebuilt integrations with popular platforms quickly connect TaxJar to your existing systems.

Our Nexus Insights Dashboard and notifications help you stay ahead of your sales tax responsibilities by state.

Our real-time calculation engine and sales tax API provides rooftop-level, product-specific sales tax.

Our reporting dashboard compiles data from all your channels to give you the most up-to-date view of your transactions and tax liability.

TaxJar AutoFile prepares and submits an accurate return and remittance for each state in which you’re enrolled.