Improved Illinois Sales Tax Report

by May 25, 2017

In our continuing efforts to have TaxJar produce sales tax reports that match the requirements of individual states, we recently updated the TaxJar state report for the state of Illinois.

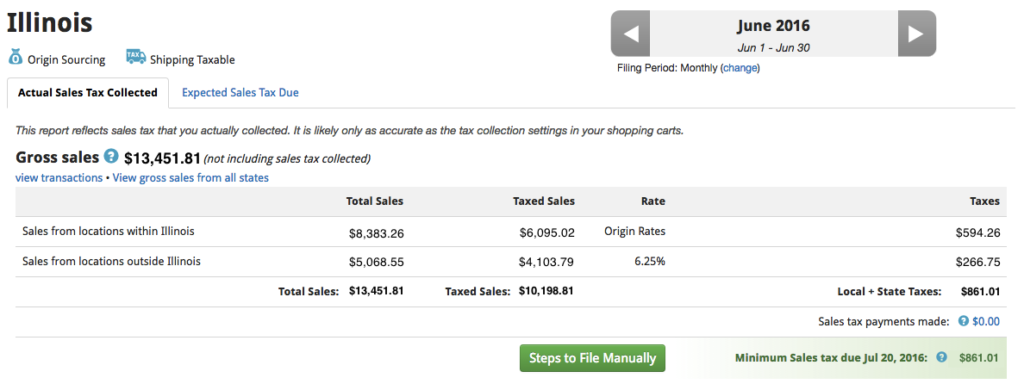

Now, then you click into your Illinois sales tax report, you will see sales and tax totals grouped according to whether the sale originated within the state of Illinois, or from outside.

This is particularly valuable to Amazon and other online sellers. Why? Because, in Illinois, Internet orders are deemed to occur outside the state (see page 6 of this document from the state for more details.)

For orders that ship into Illinois from another state, the Level the Playing Field Act act says out of state sellers should collect local ROT unless they have a physical address and are shipping from out of state. However, for orders shipped from an inventory location within the state (such as your own garage or an Amazon fulfillment center) you are supposed to collect the rate based on the location of that inventory.

The screen shot above shows what the report will look like for an Illinois-based multi-channel seller who sells most items through a traditional retail location, but also sells some Amazon FBA products originating from IL warehouses, and other orders originating from Amazon’s fulfillment warehouses throughout the country.

Hopefully, this now makes filling out Illinois sales tax return much easier.