Automated Sales Tax Reporting for Xero

by May 15, 2014

We’re pleased to announce the beginning of what we believe is going to be a great relationship with Xero – the fast-growing accounting software used by small businesses all over the world. Thanks to TaxJar’s add-on for Xero, more than 50,000 US-based subscribers can get the line item detail of sales tax collected that they need to file sales tax returns.

We’re pleased to announce the beginning of what we believe is going to be a great relationship with Xero – the fast-growing accounting software used by small businesses all over the world. Thanks to TaxJar’s add-on for Xero, more than 50,000 US-based subscribers can get the line item detail of sales tax collected that they need to file sales tax returns.

Why would accounting software need TaxJar?

Simple. The odds are, you’re tracking regular deposits from your e-commerce store that show up in your bank account. However, those deposits will also include any money you collected from customers as sales tax. That’s money you owe the state – a liability that could mean your books are wrong. Your income could be overstated, as well as your balance sheet. And we know that reconciling raw e-commerce transactions to bank deposits is incredibly difficult (e.g. figuring out how much went to fees, shipping, etc.) Fortunately, you can get your books in shape with very little effort now with our add-on.

Simple Integration

True to every other integration we’ve done, this one had to be simple (or else we wouldn’t have done it). I’m proud to say, thanks to the input of our customers using Xero, that we’ve done that.

Linking your account to Xero is the first step and it’s a snap. Just click a button in your ACCOUNT Section under Linked Accounts, log into your Xero account once, and TaxJar will take it from there, running regular updates to make sure your accounting information is accurate and up-to-date.

Welcome to Improved Accuracy

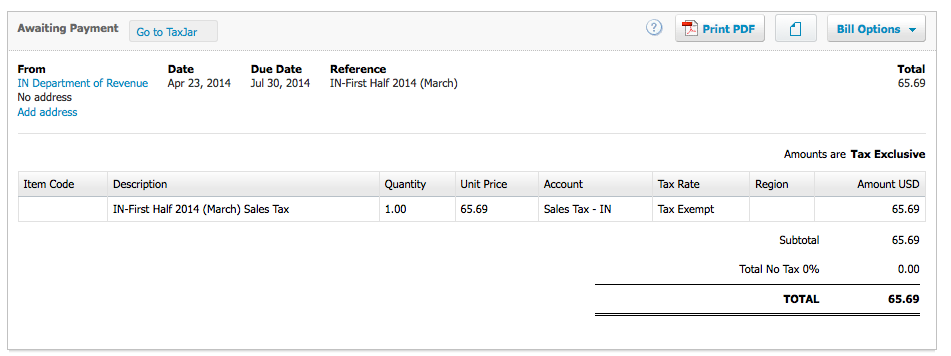

TaxJar creates new sales tax liability accounts for each state in which you collect and file. Each month, we’ll create new bills/invoices for the sales tax you’ve collected that you can export to Xero. Get that balance sheet and income statement corrected – with no additional work.

TaxJar is free for 30 days. Test it out!