Sales tax nexus occurs when your business has some kind of connection to a state. All states have a slightly different definition of nexus, but most of the time states consider that a “physical presence” or “economic connection” creates nexus. You only have to charge sales tax in the states in which you have sales tax nexus.

We’ll walk you through the ins and outs of nexus, including your next steps after determining you have sales tax nexus in a state.

Define: nexus

Each state sets their own sales tax nexus requirements, but in general, business activities that create sales tax nexus include:

- Having an office, store or other location in a state (even a home office)

- Having an employee, salesperson, contractor, etc. in a state

- Owning a warehouse or storage facility in a state

- Storing inventory in a state (such as in an Amazon FBA warehouses or other 3rd party fulfillment center)

- Having a 3rd party affiliate in a state

- Temporarily doing physical business in a state for a limited amount of time, such as at a trade show or craft fair

Economic nexus – Making a certain amount of sales in a state (either a certain dollar amount or a certain number of transactions)

If you suspect you might have sales tax nexus in a state, you could check with that state’s taxing authority to determine whether or not you have sales tax nexus and are required to pay sales tax in that state.

Subscribe to our free sales tax newsletter

Sales tax is complex, and always changing. But staying up to date on sales tax news is crucial for businesses. Sign up to stay on top of changes that can impact your sales tax compliance.

Sign upWhat happens if I have sales tax nexus?

If you have sales tax nexus in a state, then you must collect sales tax from buyers in that state.

This means you must determine the sales tax rate in that state, plus any local sales tax that might apply. For example, the sales tax rate in Beverly Hills (90210) as of this writing is 9%. That includes a California state rate of 6.5%, plus a Los Angeles County rate of 1% and a district rate of 1.5%.

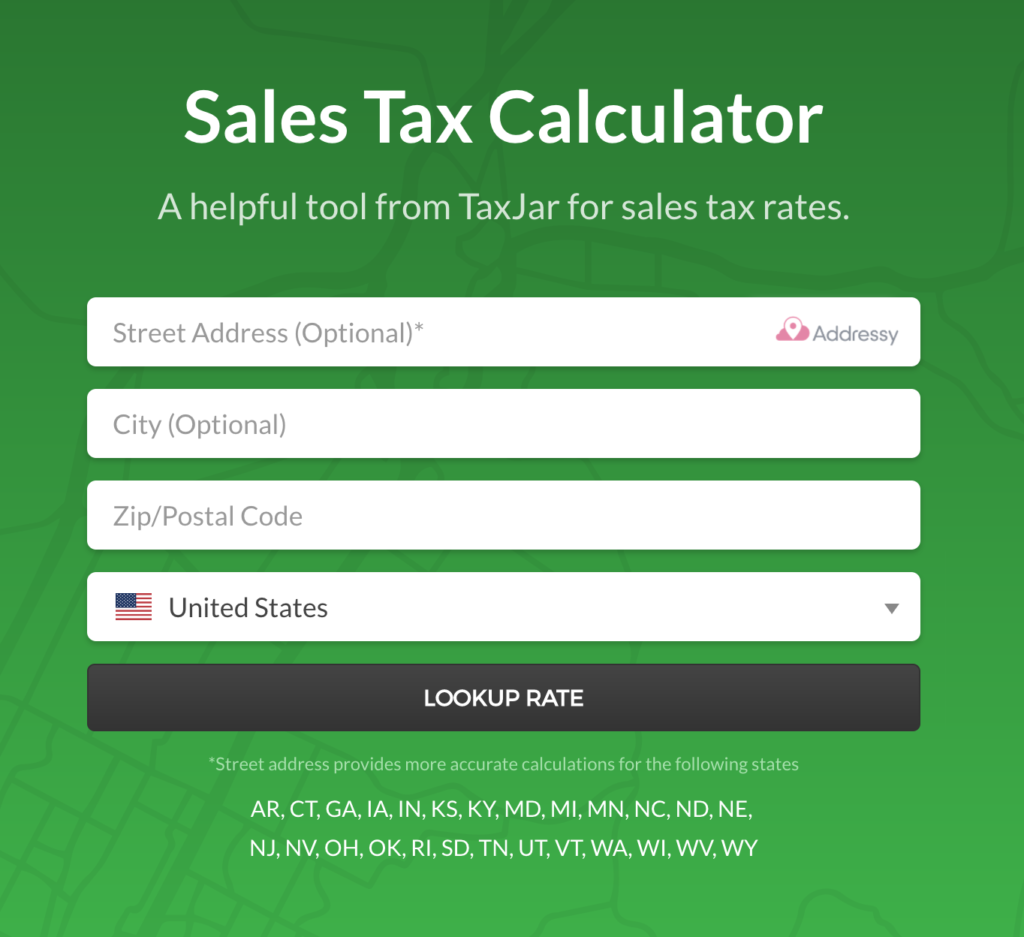

Sales tax rates will vary from locality to locality. Check with your state’s taxing authority to find your sales tax rate, or simply use TaxJar’s handy Sales Tax Calculator.

Origin-based sales tax states are fairly simple. If you are based in an origin-based state, you charge the amount of state and local sales tax effective at your business’ location to everyone who you ship taxable items to in that state. So your location would be your office, warehouse, place where your inventory is stored, etc.

Destination-based sales tax states are trickier. If you have sales tax nexus in a destination-based state, you must calculate the sales tax rate effective where your buyer is located. This means you would charge multiple sales tax rates within a state.

Not to mention, some states are different based on whether you live there (home state nexus) or you are considered a “remote seller.”

Many online sales platforms help you calculate the correct amount of sales tax to charge, but it’s ultimately up to you to ensure you are charging the correct amount.

If you’re unsure that you’re collecting the right amount of sales tax, login to your TaxJar account. The colorful indicators on your dashboard will show you how much you collected from your customers vs. how much you should have collected. It will help you ensure your platforms are set up to collect sales tax correctly and that states where you have sales tax nexus won’t come after you for over or under collecting sales tax.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.