You can Now Designate Tax Exempt or Wholesale Transactions in TaxJar

by November 21, 2017

Updated May 6, 2020

Lately we’ve been working hard to help your TaxJar account reflect the way you do business. Today we’re happy to announce that you can now designate individual transactions as “tax exempt” in TaxJar.

This means that your TaxJar “Expected Sales Tax Due” report will be even more accurate, and you can now more easily AutoFile your sales tax returns without running into any roadblocks.

Exempt Transactions in TaxJar

Many online sellers make sales at wholesale, or to exempt customers such as resellers, government entities or educational institutions.

Before this new feature, if our customers sold a taxable item to a tax-exempt buyer, we had no way of knowing that our customers were correct in not charging sales tax on that item. With this new feature, you can mark a transaction as “exempt” one time, and TaxJar will recognize that you were correct in not charging sales tax on that transaction.

How do I designate exempt or non-taxed transactions in TaxJar?

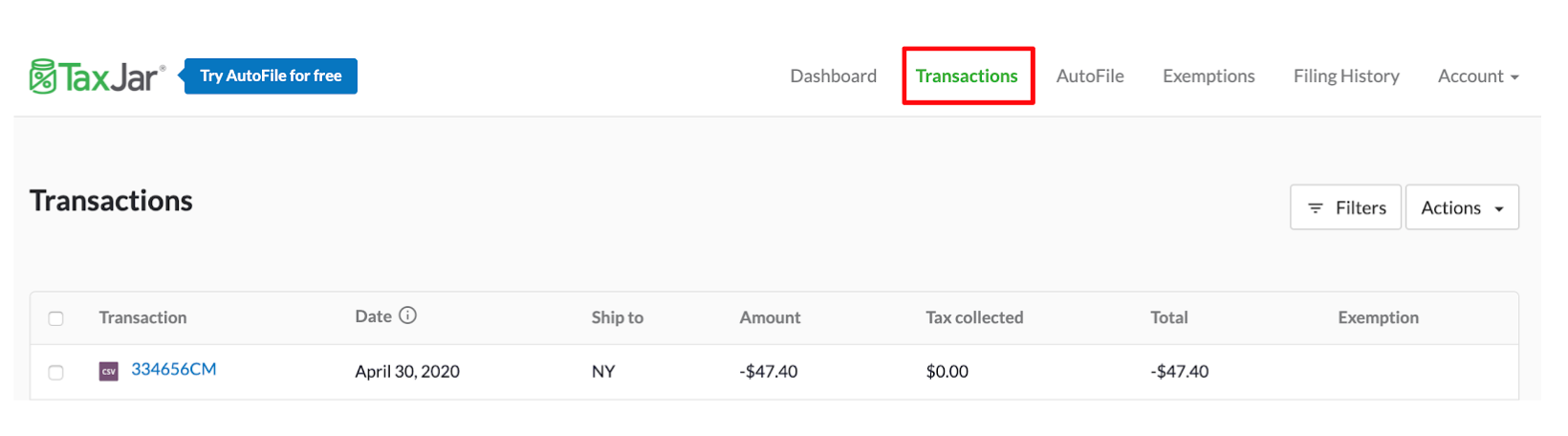

You can designate exempt or non-taxed transactions in your “Transactions” tab in TaxJar.

- Navigate to your Transactions Tab

- Click on the order number for the exempt order

- Information about the transaction will appear on screen as a popup. Scroll down to the bottom of the order and you’ll see “Is this receipt exempt?”

- Choose the reason your transaction is exempt

Now, TaxJar will know that that order was untaxed because the transaction is tax exempt.

5. Pro Tip: You can also mark multiple transactions as exempt. Save time by choosing multiple items of the same type to mark the whole group as exempt.

If you accidentally mark an item as exempt that should be fully taxable, you can undo this exemption by selecting “not exempt.”

Your TaxJar “Expected Sales Tax Due” reports will also be accurate. For example, this TaxJar customer sold items to a tax exempt school in Massachusetts. Before she designated that transaction as tax exempt, Massachusetts showed as a yellow “caution” state on her TaxJar dashboard.

But once she designates the sale to her Massachusetts customer as tax exempt, her TaxJar dashboard will reflect that she’s collecting sales tax correctly and the yellow “caution” warning will turn green.

Using TaxJar AutoFile with Tax Exempt Transactions

In the past, if you had tax exempt transactions and attempted to enroll in AutoFile, you would run into a roadblock asking you to treat all sales as taxable. Now that you can designate tax exempt, resale and wholesale transactions in TaxJar, you can bypass this roadblock and AutoFile only the sales tax you collected.

Find out more about enrolling in AutoFile here.