Navigate SaaS sales tax complexity with ease

SaaS taxability changes happen often, with states trying to keep pace with new technologies. Automation can help reduce the complexity of SaaS compliance.

SaaS taxability changes happen often, with states trying to keep pace with new technologies. Automation can help reduce the complexity of SaaS compliance.

Is an online training course taxable? What about streaming content? SaaS and digital goods taxation varies by state; some tax them as products, others as services.

We’re a SaaS company ourselves, so we know how challenging it is to track sales tax rules and rates across jurisdictions. That’s why we built our automation platform to make it as easy as possible for other modern cloud services to stay on top of the complexities.

Learn more about the TaxJar API

As your company grows, there should be no hiccups with collecting sales tax when customers buy your digital goods or subscribe to your SaaS products. TaxJar is designed to scale with your business, giving you a seamless path to growth.

See our developer documentation

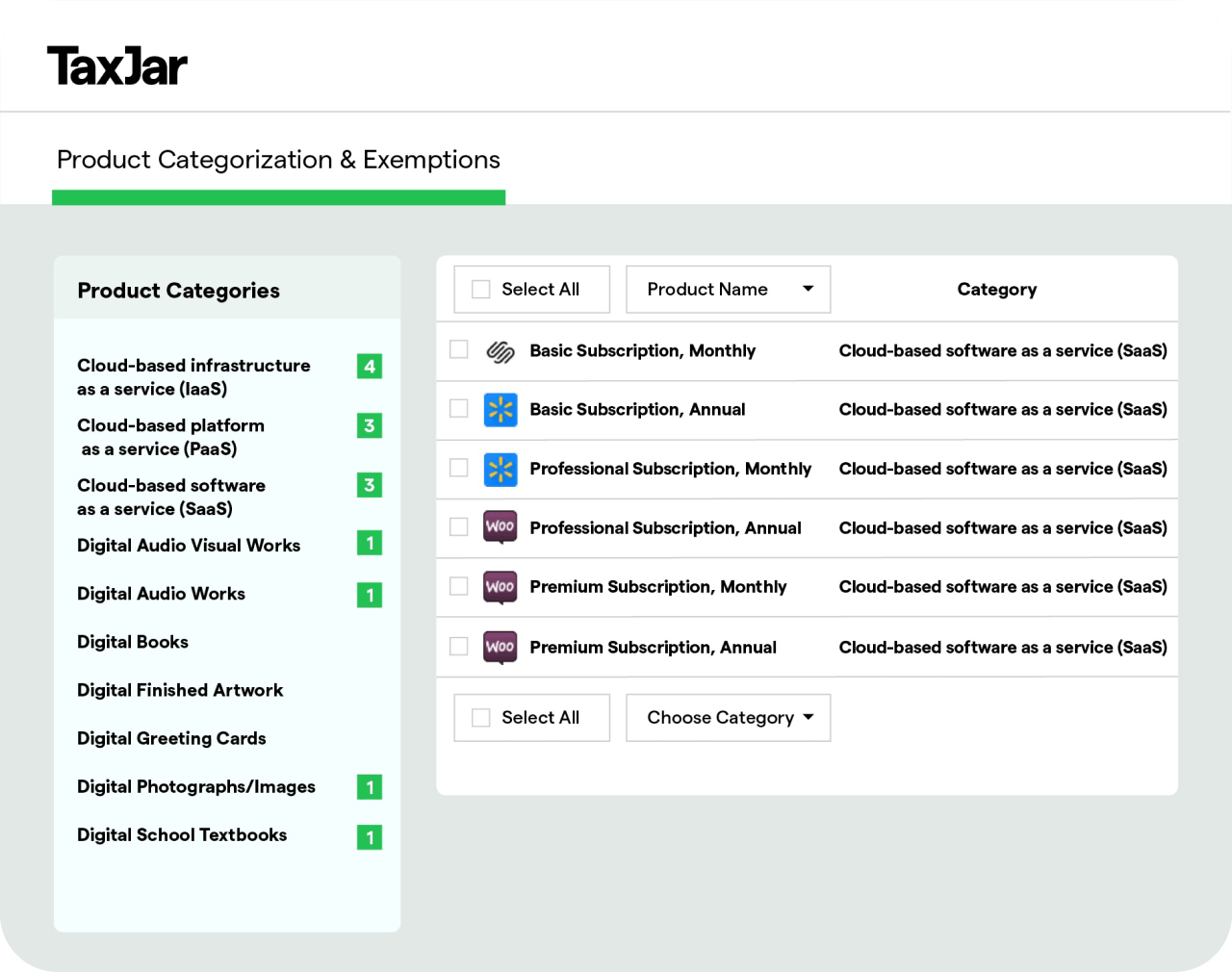

TaxJar integrates with the providers that manage your digital payments infrastructure and subscription services. Our team maintains a curated set of prebuilt integrations with popular platforms like Shopify and Chargebee. You can get set up in minutes directly from the TaxJar dashboard or use the TaxJar API to customize your integration.

TaxJar simplifies sales tax compliance every step of the way. Here’s how our platform works:

Prebuilt integrations with popular platforms quickly connect TaxJar to your existing systems.

Our Nexus Insights Dashboard and notifications help you stay ahead of your sales tax responsibilities by state.

Our real-time calculation engine and sales tax API provides rooftop-level, product-specific sales tax.

Our reporting dashboard compiles data from all your channels to give you the most up-to-date view of your transactions and tax liability.

TaxJar AutoFile prepares and submits an accurate return and remittance for each state in which you’re enrolled.