Sales tax power of attorney forms for every state

by November 20, 2025

In some cases when TaxJar AutoFile’s your sales tax return, a power of attorney (POA) form is required for TaxJar to AutoFile your return.

We explained why some states require powers of attorney in this post.

But now that you know why TaxJar (or an accountant or other tax professional) might ask for a power of attorney, we thought we’d make a list of all of the various state sales tax-related power of attorney forms.

List of state sales tax power of attorney forms

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada – Nevada does not provide a power of attorney form, however they accept most generic power of attorney forms including IRS Form 2848

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

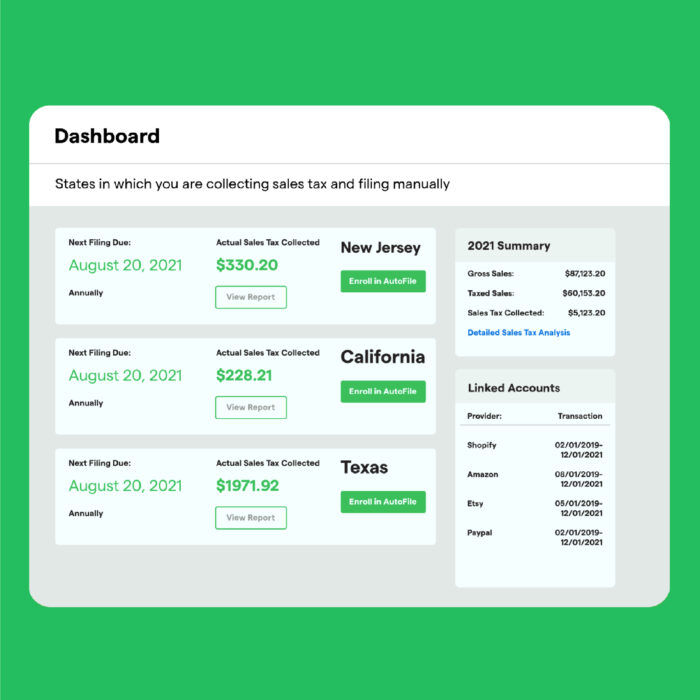

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.