How retail leaders should manage clothing taxability

by February 22, 2025

In the world of sales and use tax, most tangible personal property is taxable. Keep in mind, however, that in this world, the phrase “it depends” comes up quite a bit.That’s because individual states determine how each product is taxed, or if it’s taxed at all, and that makes compliance a challenge. Clothing and retail sales fall under this confusing category, with varying taxability guidelines across states, cities, and individual retail items.

We’ll walk through the challenges clothing retailers face, and some common mistakes to avoid.

Clothing taxability challenges

As we’ve mentioned previously, most tangible items are considered taxable, and the majority of states tax clothing items to a certain degree. But as always, it depends on the state.

A handful of states have legislated that clothing is either entirely non-taxable or only taxable when priced above a certain dollar amount. Making matters more complicated are states like Connecticut, a state that poses a luxury tax on clothing and footwear priced at more than $1,000. This sales tax variability creates confusion for clothing retailers. And it gets even more challenging for a multi-state retailer. What’s considered taxable in one state might not be taxable in another, or might be taxed at a different rate. Not sure if clothing is taxable in your state? Check out our full list of clothing taxability by state.

Another tricky area for retailers to consider is the impact of sales tax holidays. These holidays are designed to spur consumer sales online and in brick-and-mortar locations by providing the incentive of tax free purchasing for a specific amount of time. Apparel and shoes under a certain dollar amount are often included in these holidays. If a retailer generally taxes an item of clothing, they need to be aware of any sales tax holidays that legislate a tax-free period to avoid collecting sales tax erroneously. Here’s a full list of the 2022 sales tax holidays.

Common mistakes

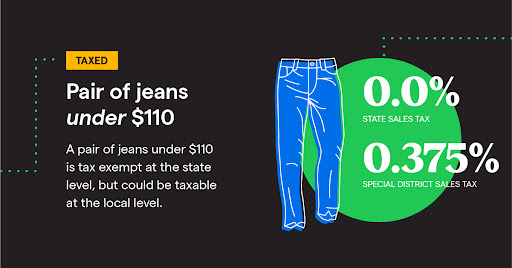

The most common clothing taxability mistake is assuming all clothing is taxable in a state, or assuming all clothing is taxed at the same rate. We’ll walk through an example that showcases the sales tax challenge retailers face:

As you can see, clothing taxability is not one size fits all. This jean retailer in New York must exempt state sales tax on jeans under $110, but collect state sales tax on jeans over that price point. After they determine the state sales tax requirements, they must also determine local sales taxability. Retailers must perform all of this work for one retail item.

Another example is in Minnesota, where clothing is tax exempt, but accessories, most protective equipment, sports and recreational clothing, and fur clothing are taxable. Operating under the assumption that all clothing items and accessories are taxable can be a costly and potentially litigious mistake.

In order to stay compliant, it is imperative that retailers are aware of the different product taxability laws in their state to ensure they are collecting the correct amount of sales tax from their customers. Whether you’re selling jeans, t-shirts, accessories or outdoor apparel, a miscategorized product can create compliance issues. Use our free sales tax calculator to determine which sales tax rate you should be charging customers, which is a combination of state and local sales tax rates.

Ready to automate sales tax? Sign up for a free trial of TaxJar today.