How to request a California sales tax extension

by November 1, 2024

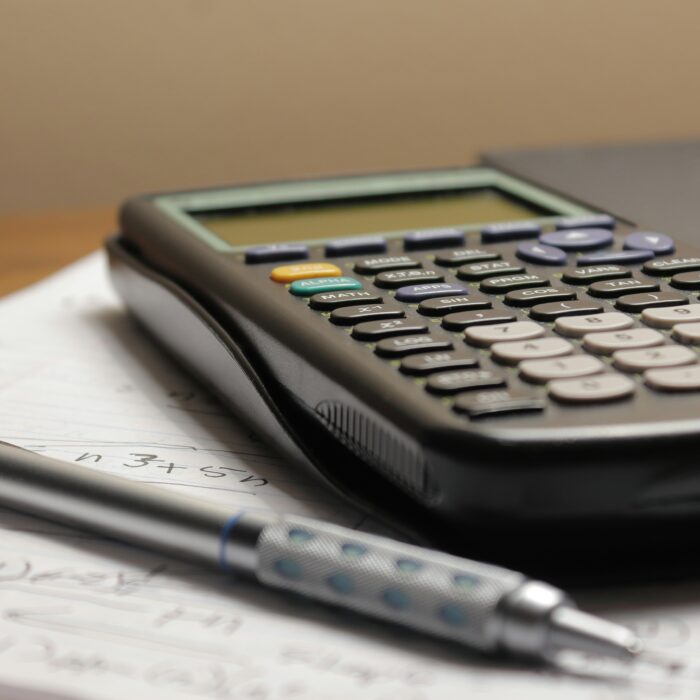

We get it. Tallying up how much sales tax you collected in each California city, county and district over every channel you sell on is time-consuming, if not downright painful.

Fortunately, California will – under limited circumstances – allow you to request a 30-day sales tax filing extension. This extension can be requested up to 30 days following your missed filing date.

Why would you want to request an extension?

- You can neither file nor remit the sales tax you’ve collected on-time.

- You can remit what you owe on time but need to file your return late. In this case you are still subject to a late filing penalty.

- You can file on time but need to remit what you owe late. In this case you are still subject to interest on the amount of sales tax collected you haven’t yet remitted to the state.

Keep in mind this is a filing extension and not a payment extension. Even if you are granted an extension on your time to file your California sales tax return, you will still owe interest on any payment that was due.

How to request a California sales tax extension

- Login at the California DTFA e-File Website

- Once logged in, fill out the “Declaration of Intent to Submit an Online Relief Request”

- Select a “Reason for Request”

- Select your filing year and period

- Enter the title of the person completing this request

You should receive a confirmation number immediately upon sending your request.

Once submitted, your request could be processed immediately, could take up to 30 days or – should it need to be reviewed by California taxing authorities, take from 90-120 days. Keep in mind that if this happens you may be liable for penalties and interest during this time if your request isn’t ultimately granted. And that you will be liable for interest on a late payment even if the filing extension is ultimately granted. If your request isn’t granted immediately you can check online at your CDTFA account.

What to do after you’ve requested a CA sales tax extension

Your extension will go by quickly, so I recommend trying to get California sales tax filing out of the way as soon as possible. After all, you are still on the hook for interest on any sales tax you may owe to the state.

We have a couple of resources that can help you get ready and get your California sales tax filing out of the way.

1.) A step-by-step How to File a California Sales Tax Return blog post

2.) A step-by-step How to File a California Sales Tax Return video

These resources will hep you get your California sales tax return filed and get on with running your business!

More California relief requests

Speaking of extensions, an extension for time to file is not the only “relief request” that California will grant. You can also apply for:

- Relief from Penalty

- Relief from Interest due to an unreasonable error or delay by CDTFA or the DMV

- Relief from Penalty and Interest Due to a Disaster (State of Emergency Tax Relief guide)

- Relief from Collection Cost Recovery Fee

- Declaration of Timely Mailing

- Extension of time which to file/pay another tax fee/return

Do you have questions or comments about filing a California sales tax extension? We recommend starting with the California Relief Request FAQ.