How to handle orders that show up after you’ve already filed sales tax

by February 27, 2025

One of the challenges with handling sales tax remittance for large volume businesses is that you often have a small window in which to summarize all of your sales information from the prior period. And with some e-commerce platforms, orders that come in near the end of the month don’t always show up as completed by the end of that month. We have had cases where merchants file their sales tax returns for a month, only to find in the next few days that a few more orders came in. That leaves merchants with an awkward choice of either filing an amended return, or manually tracking down those late orders and adding them to the following period.

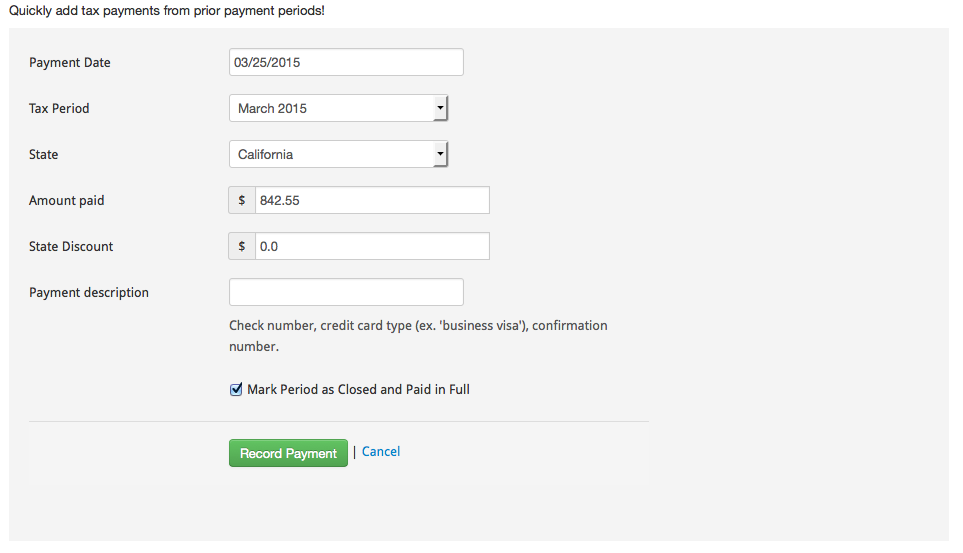

To help with this scenario, TaxJar has a feature which allows you to mark a period as “Closed and Paid in Full”

By doing so, you are telling TaxJar that you have filed a return for the transactions in that period. Should any new orders come in with order dates that would have placed them in the prior period, TaxJar will place them in the current period using the date the transaction was imported into TaxJar. This way, all “late” orders will be properly filed in the next period.

Going forward, these “late” transactions will show up in the TaxJar interface based on when they were imported (and in the month they will be reported/filed.) This includes in the Transactions view.

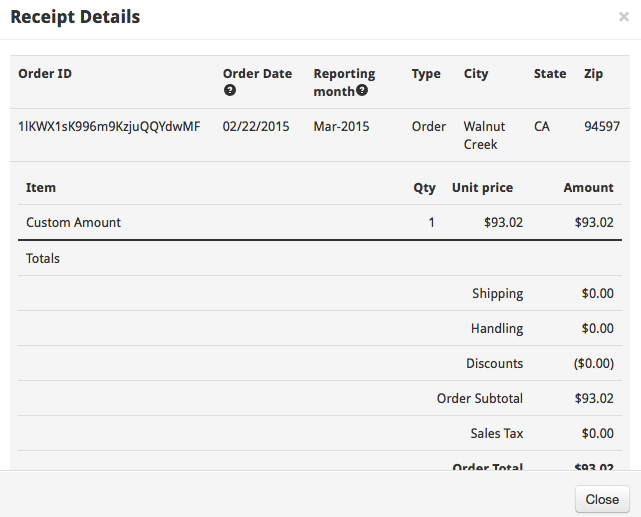

However, you can always see the original order date for these transactions by clicking the plus sign to view the transaction’s details.

AutoFile your sales tax returns

With TaxJar AutoFile, TaxJar pulls in all of your sales data from all of your online shopping carts and marketplaces, and then automatically files your sales tax returns on time, every time. You won’t have to manually track orders and worry about amended returns, TaxJar can automate sales tax filings for you.

AutoFile requires just a one time enrollment. After that, you can forget about sales tax filing and get back to running your e-commerce business. Get started with AutoFile today.