How to register for a sales tax permit in Ohio

by March 1, 2025

This guide will walk you through what you need to know to register for a sales tax permit in Ohio. For more information about sales tax in the Buckeye State, check out our Ohio Sales Tax Guide.

How to register for a sales tax permit in Ohio

1. Who needs a sales tax permit in Ohio?

Ohio requires any person or business making retail sales of tangible personal property or taxable services to register for the sales tax by obtaining a “vendor’s license.”

2. How do you register for a sales tax permit in Ohio?

You can register for an Ohio sales tax permit in one of two ways:

Register online at the Ohio Business Gateway.

In state based sellers: Choose “County Vendor’s license.”

Out of state based sellers: Choose “ Ohio Taxation – New Account Registration and Fuel Permit” and then Choose “Sellers Registration.”

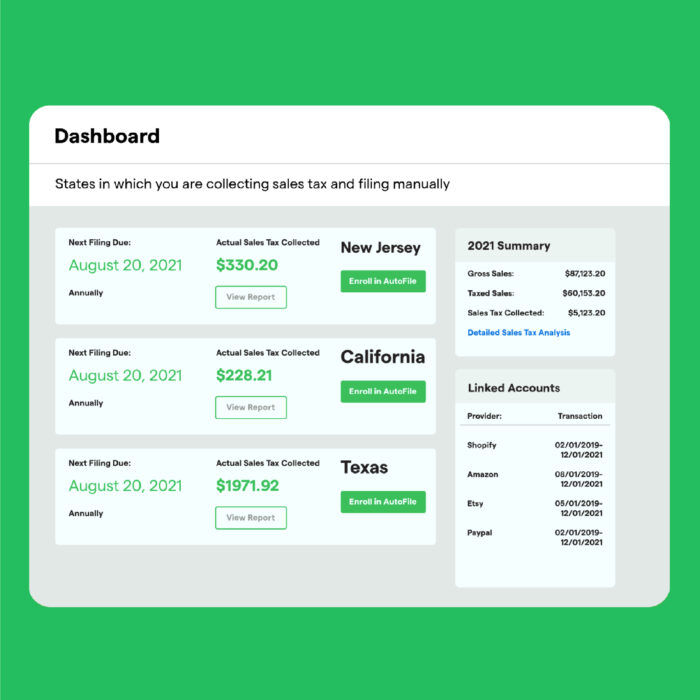

Let TaxJar manage your sales tax registrations

Before you can collect sales tax from customers, you must first register for a sales tax permit with the state. However, this process can be cumbersome and time consuming. See how TaxJar can manage this registration process for you.

Learn more3. What information do you need to register for a sales tax permit in Ohio?

- Business identification information

- Business entity

- Locations

- Date you will begin collecting Ohio sales tax

- NAICS Code

4. How much does it cost to apply for a sales tax permit in Ohio?

For sellers located in Ohio an Ohio sales tax permit (form ST-1, called a vendor’s permit) is $25 and you must pay via ACH debit.

For “remote sellers” (sellers located outside of Ohio but required to collect sales tax in Ohio due to sales tax nexus) form UT-1000 is free.

Other state registration fees may apply.

5. How long does it take to receive your Ohio sales tax permit?

While Ohio isn’t specific about how soon they’ll send your Ohio sales tax permit, you can generally expect to receive a sales tax permit within 10 business days.

6. Do you have to renew your Ohio sales tax permit?

You are not required to renew your Ohio sales tax permit.

7. How can I learn more about Ohio sales tax?

- Read our Ohio Sales Tax Guide for Businesses

- Find the best contact number to call the Ohio Department of Revenue

Want to learn more about TaxJar? Get started today!