How to determine where you have sales tax nexus as a FBA seller

by November 5, 2024

FBA sellers have complex sales tax needs. This is because FBA sellers usually have sales tax nexus in multiple states due to storing inventory there. With TaxJar, you can login and TaxJar will show you badges next to states where your Amazon FBA orders have shipped from.

For new TaxJar users: When you sign up for your 30-day free TaxJar trial and connect your Amazon Seller Central account, we will determine from which states you ship orders.

For all TaxJar users: Login and check out your dashboard or your state settings page. A small badge will appear by the states where your FBA inventory has shipped.

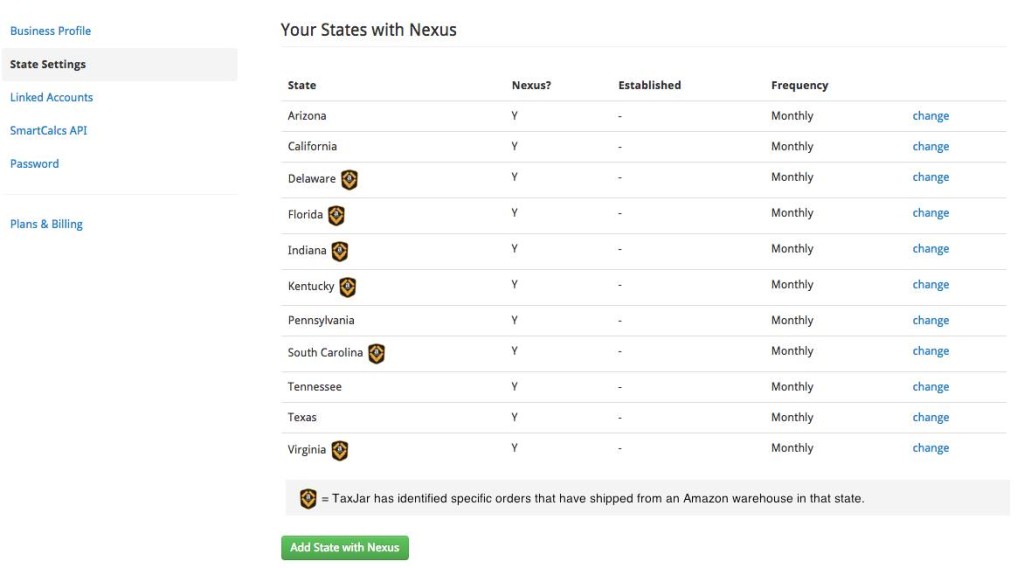

Your state settings page will look like this. Amazon badges indicate states where we show you have nexus.

Note for existing users: For existing users, you may have been tracking sales in FBA states where you may or may not have nexus, depending on whether you had orders ship through there. We will be using the last month’s data to determine for sure which states you shipped orders through. If you find that you now see some FBA states on your dashboard and state settings page, but they don’t have badges next to them, let us know by emailing [email protected] and we can re-run your data going back to the beginning of the year. If no orders are found to have shipped through a state you’ve been tracking, and you otherwise determine you have no nexus there, you can remove it from your dashboard.

Important note

This feature will tell you from where your orders have shipped. In a small number of cases you may have inventory stored in a fulfillment center (thus creating nexus), but perhaps your items haven’t shipped out of that fulfillment center in awhile. Because Amazon’s fulfillment network is so tightly structured this rarely happens, but we want you to be aware of every contingency. If you think you have nexus in a state due to inventory but don’t see that state show up on TaxJar, you can also follow these instructions to run an Amazon inventory event detail report.

So if you have been wondering where FBA gives you sales tax nexus, sign into you TaxJar account, or sign up for your 30-day free trial, and find out!

If you have any problems with this feature, contact us at [email protected].