Unlocking efficiency: The time-saving benefits of sales tax automation

by August 1, 2025

At TaxJar, we understand how much time it takes to be sales tax compliant. In fact, we built an entire company to solve for it. From understanding where you have sales tax responsibilities, to registering for a sales tax permit, to filing and remittance, the process can take valuable time away from running your business.

This got us thinking: exactly how much time do businesses save by automating their filing and remittance with a partner like TaxJar? We decided to analyze industry benchmarks to determine how much time a business can save by automating filing and remittance each month.

Sales tax filing challenges

Before we dig into the numbers, let’s recap why sales tax filing and remittance is so challenging.

In the US, each state makes their own sales tax laws, product taxability rules, and filing processes. There are 46 states with a state sales tax, and because sales tax is managed at the state level, there are 46 different filing formats and processes to follow.

Because each state is allowed to administer sales tax however they prefer, you’ll often find that each one has adapted the sales tax system to their own preference. Filing frequencies also vary by state, and for businesses selling in multiple states, it can be time consuming to keep up with all the different due dates.

On top of the varying filing requirements, certain states are more challenging to file in than others. For example, there are “home rule states” that create sales tax complexity. Home rule states allow individual home rule cities to administer their own sales taxes as well as define their own tax bases. These cities can define their own tax rules and sellers may be required to complete additional registrations in these areas. The following are home rule states: Alabama, Alaska, Arizona, Colorado, and Louisiana. Filing in home rule states is complex and time consuming.

In addition to home rule states, there are a number of states that have complex filing requirements where the state requires reporting on a large number of local taxing jurisdictions. For example, Texas’s sales tax return requires sales to be separately reported for each of their 3,700 cities, 125 countries, 490 special purpose districts, and 10 transit districts.

Time analysis: The efficiency gains of sales tax automation

After reviewing industry benchmarks and creating some basic estimates, we were able to determine generally how much time could be saved by automating filing and remittance. There are unique factors to consider such as how much knowledge a user has about filing and remittance and their general technical knowledge, but these estimates provide an average of time spent each month.

To file in states that have simpler filing requirements, it takes an average of 45 mins per state to manually complete a sales tax report, file, and remit sales tax owed. The states with complex filing requirements or home rule cities, take an average of three hours per return.

For illustrative purposes, let’s say it takes an average of 1.5 hours to manually file in each state, considering both simple and complex filing processes. Here’s how much time a company could spend manually filing each month, depending on their filing requirements:

| Number of states with monthly sales tax requirements | Time spent manually filing each month |

| One state | 1.5 hours |

| Five states | 7.5 hours |

| 15 states | 22.5 hours |

| 30 states | 45 hours |

| 46 states | 69 hours |

As you can see, manually filing and remitting is a time consuming process. On top of the time wasted it’s easy to make mistakes when filing manually, like accidentally making calculation errors or pulling data for the wrong channel or state. It’s also easy to miss due dates. Most states charge late penalties, usually a percentage of sales tax due, for businesses that file late. With all of these factors in mind, manually filing sales tax can be risky for a business, especially multi-channel sellers, or businesses filing in multiple states.

It’s also important to note that we’re only mentioning one portion of sales tax compliance. There are six essential steps to sales tax compliance:

- Determine nexus responsibilities: In the US, retailers are required to collect sales tax from buyers in states where they have sales tax nexus. Sales tax nexus requirements vary by state, but generally they are transaction or revenue-based.

- Verify product taxability: In the US, most “tangible personal property” is taxable. However, product taxability varies by state. Businesses should only charge sales tax on items that are taxable in that state.

- Register for sales tax permits: Each state’s taxing authority handles sales tax registration. You can register for a sales tax permit yourself, or let TaxJar handle the registration process for you.

- Set up sales tax collection on your sales channels: Once you have your valid sales tax permit, your next step is to begin collecting sales tax from your customers. Each online shopping cart and marketplace allows you to set up sales tax collection.

- Report how much tax you collected: When preparing to file a state sales tax return, you need to determine how much sales tax you collected from buyers in not only the entire state, but in each county, city and other special taxing district.

- File sales tax returns: Your next step is to file your sales tax returns with the state. Most states allow you to file sales tax online, and some require it.

There are multiple steps a company must take before they even file and remit sales tax each month, and each step takes additional time.

Not to mention, when a company meets nexus in a new state, they are required to register for a sales tax permit in that state before collecting sales tax. The registration process varies for each state. Certain states have straightforward registration processes that might only take 30 minutes to complete. However, other states have extremely long registration processes that can take upwards of three hours.

How to save time and money automating tax compliance with TaxJar

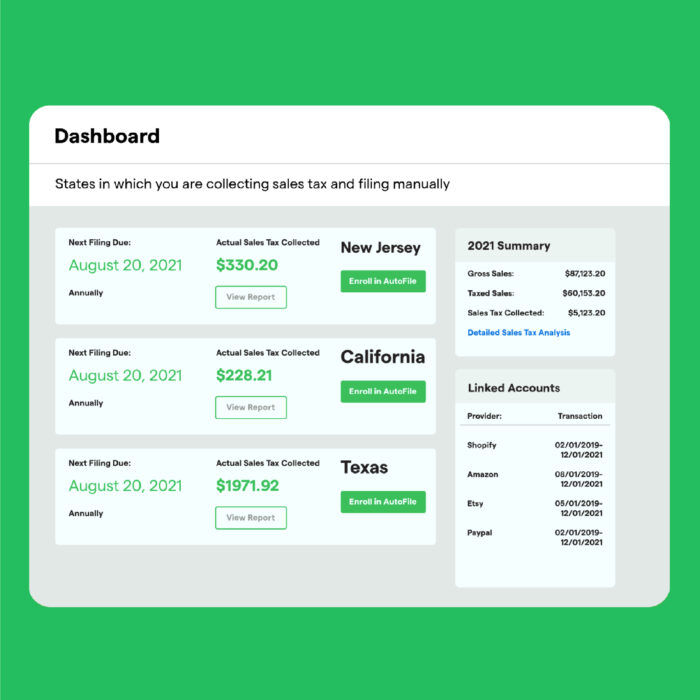

Fortunately, there is a better way to file and remit sales tax: automation. TaxJar’s AutoFile streamlines the entire filing and remittance process, giving you valuable time back to focus on growing your business, instead of navigating state websites each month. Once enrolled in a state, you won’t have to worry about correctly completing a return, or missing a due date. With AutoFile, businesses know their returns will be filed correctly, without errors, by the due date, backed by our guarantee.

Not only does TaxJar manage filing and remittance, but you can outsource the entire sales tax compliance process, from monitoring nexus thresholds to registering for sales tax permits.

The good news is that getting started with TaxJar is easier than filing and remitting sales tax. Get started today with a 30-day free TaxJar trial, no credit card required. If you have questions about how TaxJar can help your business save time and money, reach out to our sales team today.