Sales tax compliance checklist for 2026

by December 11, 2025

Sales tax rules shifted dramatically in 2025, with more than 400 rate changes across the country. On top of rate changes, states also made updates to product taxability rules like grocery items and SaaS offerings.

As these changes go into effect, staying compliant becomes more challenging. From understanding economic nexus thresholds to product taxability nuances, tax compliance is not a straightforward task. Our five-step checklist aims to break down the different aspects of compliance so you are ready for growth in the year ahead.

1. Make sure you understand where you have sales tax nexus and are required to collect sales tax

Retailers in the US are required to collect sales tax from buyers in states where they have sales tax nexus. There are two different types of sales tax nexus, or in other words, two different ways you can meet the requirements to collect and remit sales tax to a state: physical nexus and economic nexus.

Physical nexus is just that, a physical connection to a state. Examples of physical nexus (also sometimes referred to as “physical presence”) include employees, offices, stores, warehouses, conference attendance, servers, etc.

Economic nexus thresholds are based on revenue or sales amounts. For example, in Florida, sellers that hit $100,000 in revenue from buyers in the state in the previous calendar year have met the economic nexus threshold in the state. Other states, like Georgia, have both a transaction and revenue threshold: $100,000 a year in gross revenue, or 200 separate transactions in the previous or current calendar year. Once you’ve hit a threshold in a state, you must register for a sales tax permit before collecting sales tax.

End of year sales often push businesses over economic nexus thresholds so now is a good time to check where you have nexus, or where you might be approaching a nexus threshold. A solution like TaxJar can manage this on your behalf, with our nexus insights tool. With TaxJar, you don’t have to manually track nexus thresholds. Instead, you can receive alerts when you are approaching or hit a threshold and need to register for a sales tax permit in a new state.

Once you hit a threshold, TaxJar can register for sales tax permits on your behalf: visit our registration page to request our team of experts manage your sales tax registrations.

2. Check in on product taxability rules

In the US, most “tangible personal property” is taxable. In other words, most items like kitchen appliances, home decor, hair products, reusable water bottles, etc. will be subject to sales tax.

Taxability of “necessity items” varies by state. For instance, most states don’t tax groceries, though restaurant prepared food is usually taxable. Similarly, while some states exempt most clothing from sales tax, they often tax luxury apparel, like clothing taxed over $150.

What makes compliance so challenging is when product taxability rules change, which they often do. In 2025, several states updated how they tax essential items to ease the economic burden on consumers, often in states where inflation is high. For example, Kansas eliminated the sales tax on grocery items while Mississippi reduced the sales tax rate on grocery items. We highlight more sales tax trends and changes for 2026 in our free guide.

These frequent and sudden changes demand that businesses stay vigilant and update their checkout processes accordingly. TaxJar simplifies this task by automatically adjusting rates to provide a more accurate sales tax collection.

3. Set up sales tax collection on all your sales channels

Are you expanding to new sales channels in 2026? Don’t forget to set up sales tax collection on all of your sales channels. Each online shopping cart and marketplace allows you to set up sales tax collection. Here’s where you can find guides on how to set up sales tax collection on the major shopping carts and marketplaces.

Selling on a popular marketplace? Marketplace facilitator laws laws require marketplace facilitators to collect and remit sales tax on behalf of their third-party sellers’ transactions. For sellers, marketplace facilitator laws mean that your facilitator will handle collecting and remitting sales taxes on behalf of your sales in states where your marketplace is compliant.

However, marketplace sellers aren’t always off the hook. Marketplace sellers often ask if they should keep their sales tax permits current if they are impacted by marketplace facilitator laws. The general consensus is yes. Remember, a facilitator only handles the sales tax on transactions sold through its platform. You are still responsible for managing sales tax on transactions outside of the marketplace.

Here’s an example. If Amazon is collecting sales tax on your behalf in Washington, but you are located in Washington and you sell items through your business website, too, you still need to collect, remit, and file in the state on your own. To do that, you must have a current license or permit. And in most states, if you don’t conduct sales outside of those with the facilitator, you’re required to file a simple “zero return” saying so, or register for non-reporting sales tax status.

4. Make your sales tax data easy to use

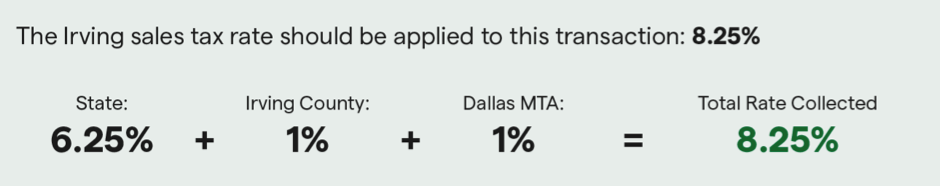

When preparing to file a state sales tax return, you need to determine how much sales tax you collected from buyers in not only the entire state, but in each county, city and other special taxing district. Here’s an example of how sales tax reporting breaks down for a a sale in Texas:

Sales tax revenue is essential for states, funding critical infrastructure, public safety, and other budgetary needs. However, accurately allocating these funds to the correct cities and local areas requires detailed transaction breakdowns. This necessary step is precisely what makes manual sales tax reporting so time-consuming and difficult.

In a small number of states, like origin-based states or states that only have a single statewide sales tax rate, filing sales tax isn’t very difficult. But, in most cases, breaking all your transactions down manually is a time-consuming chore, especially if you are a high-volume seller or you sell on multiple channels. This is why it’s so important to make your sales tax data easy to use.

TaxJar can make this easier. Our platform compiles e-commerce orders into a single dashboard, featuring all transactions, state-by-state reports with detailed breakdowns, and taxability reporting for reduced and exempt items.

5. Automate your filing and remittance

Filing sales tax returns is a tricky, time consuming task that contributes nothing to your business’ bottom line. In fact, we recently analyzed industry benchmarks to determine how much time a business can save by automating filing and remittance each month, including factors such as how much knowledge a user has about filing and remittance and their general technical knowledge, but these estimates provide an average of time spent each month.

To file in states that have simpler filing requirements, it takes an average of 45 mins per state to manually complete a sales tax report, file, and remit sales tax owed. The states with complex filing requirements or home rule cities, take an average of three hours per return.

Let’s say it takes an average of 1.5 hours to manually file in each state, considering both simple and complex filing processes. Here’s how much time a company could spend manually filing each month, depending on their filing requirements:

| Number of states with monthly sales tax requirements | Time spent manually filing each month |

| One state | 1.5 hours |

| Five states | 7.5 hours |

| 15 states | 22.5 hours |

| 30 states | 45 hours |

| 46 states | 69 hours |

As you can see, manually filing and remitting is a time consuming process. On top of the time needed, it’s easy to make mistakes when filing manually, like accidentally making calculation errors or pulling data for the wrong channel or state. Most states charge late penalties, usually a percentage of sales tax due, for businesses that file late. With all of these factors in mind, manually filing sales tax can be risky for a business, especially multi-channel sellers, or businesses filing in multiple states.

TaxJar’s AutoFile streamlines the entire filing and remittance process, giving you valuable time back to focus on growing your business, instead of navigating state websites each month. Once enrolled in a state, you won’t have to worry about correctly completing a return, or missing a due date. With AutoFile, businesses know their returns will be filed correctly, without errors, by the due date, backed by our guarantee.

Ready to make 2026 the year you simplify your sales tax compliance?

TaxJar can help. Our cloud-based platform automates the entire sales tax life cycle across all of your sales channels — from calculations and nexus tracking to reporting and filing. With innovative technology and award-winning support, we simplify sales tax compliance so you can grow with ease.

Automating your sales tax through a trusted solution increases efficiency and accuracy, but also allows you to focus on what’s most important: running your business. With TaxJar, you can swap the hours you’d spend navigating multi-state payment processes with automatic monthly reports, on-time filings, and friendly support when you need it the most. Get started for free with a 30-day TaxJar trial today, or reach out to our sales team if you have any questions.