What to know about annual sales tax reconciliation

by November 5, 2025

Filing sales tax returns monthly, quarterly or annually is not unusual. But if you’re filing in the states of Hawaii or Michigan, it’s important to make sure you’re also filing an annual reconciliation. Each state has its own reason for requiring this annual reconciliation, which we detail below.

Hawaii

Form G-49 is the Annual Return and Reconciliation form for Hawaii, and serves as your annual report to the state. If you’ve already filed and reported accurately prior to this, no additional tax is due. However, if you need to make corrections to previous filings, form G-49 may be used for that purpose.

Due dates

The due date for your annual reconciliation is the 20th day of the fourth month following the close of the taxable year. For calendar year filers, the due date is April 20th of the following year. You can file this form at Hawaii Tax Online. Or, just let TaxJar AutoFile handle your Hawaii annual sales tax reconciliation.

Michigan

Michigan does not require that sales tax filers categorize deductions on their monthly or quarterly returns, but it is required on annual reconciliation. Keep in mind that all businesses are also required to file an annual return each year.

Due dates

For annual filers, the due date is generally at the end of February, with a discount given for early remittance. Michigan publishes fillable tax forms, including form 5081 for annual sales tax reconciliation, here. Taxpayers can also file online at Michigan Treasury Online. Or, just let TaxJar AutoFile handle your annual sales tax reconciliation in Michigan.

Important note: Rhode Island historically has required sellers to submit an annual reconciliation, but removed this requirement in 2023.

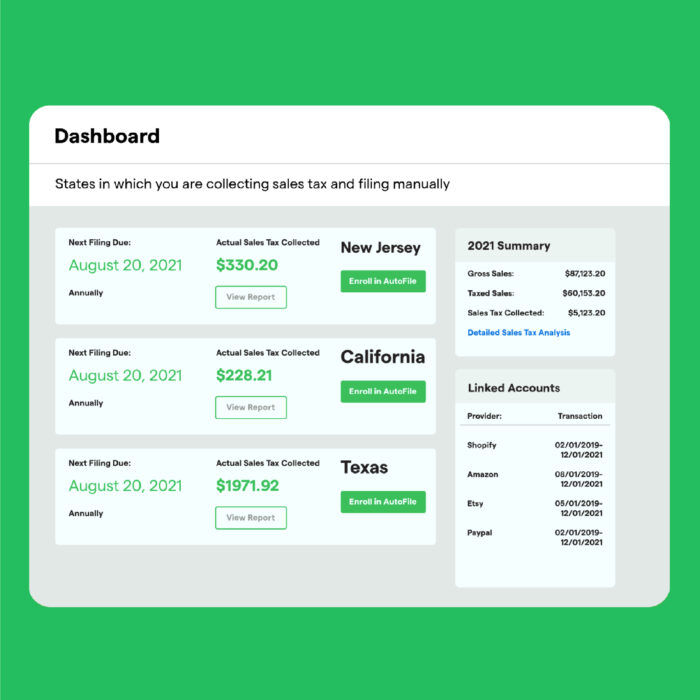

See how TaxJar streamlines annual reconciliations here.