Why human expertise is essential in an automated sales tax world

by May 30, 2025

In today’s fast-paced business environment, sales tax compliance can be a daunting task for companies, especially those operating across multiple jurisdictions. However, with the help of sales tax automation tools, navigating compliance is significantly more manageable. It’s not all about the automation though–there’s still a need for human oversight when it comes to maintaining compliance.

We interviewed a few TaxJar filing team members to understand how sales tax automation and human expertise work together to streamline the sales tax filing process, enhance compliance, and ultimately save businesses valuable time and resources.

Common challenges in sales tax filing

Filing sales tax is often riddled with challenges. According to our filing experts, one of the most notable difficulties is managing filing frequencies and ensuring compliance with changing regulations. With more than 13,000 taxing jurisdictions in the US, keeping track of changes to filing requirements can be incredibly time-consuming. States make changes often throughout the year, and companies must adapt quickly to maintain compliance.

Each state has their own filing process as well, with their own unique set of forms and processes. Depending on the state, some filings can be completed in about five minutes, while some can take multiple hours. We recently did some research that indicates how this is especially true as a company’s sales tax obligations grow to multiple states:

Automation tools play a crucial role in addressing these challenges but there’s still a need for human expertise. Not all state tax authorities provide electronic filing methodologies, making filing even more time-consuming in these states. For example, in Hawaii and Maryland, the state sales tax website doesn’t allow businesses to upload sales tax data via spreadsheet or CSV file. In order to file in these states, businesses must manually input sales tax data, number by number, to properly complete the sales tax return.

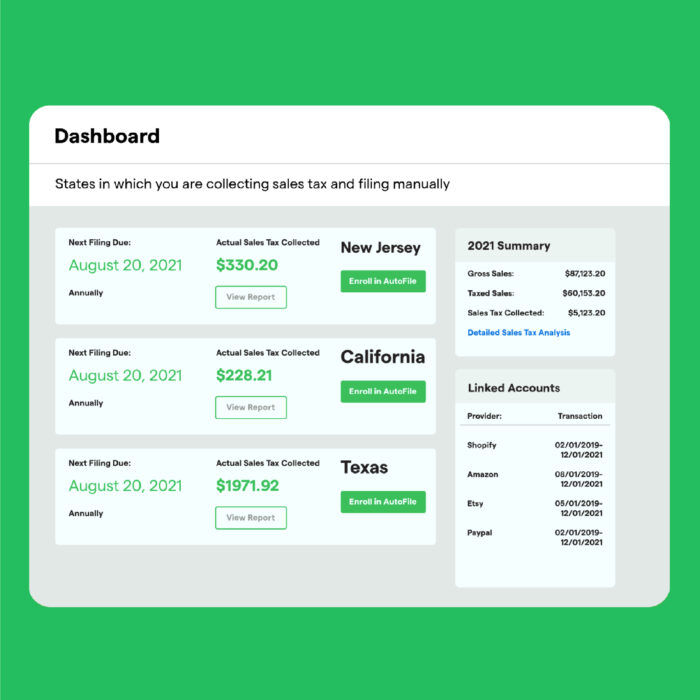

For customers enrolled in AutoFile, TaxJar’s automated filing service, they don’t have to worry about these filing nuances–AutoFile, automates in all US states with a state sales tax.

The human touch in automation

Like we mentioned above, it’s not all about automation. TaxJar combines advanced technology with human expertise to create a streamlined compliance process for businesses.

Our tax engine actively calculates the correct sales tax amount in real-time by integrating with a business’s e-commerce platform. The technology considers various factors, such as varying state and local tax rates, product categorizations, and changing legislation, to ensure accuracy.

However, the human touch remains essential in this process. Despite the efficiencies offered by automation, there remain tasks that require human oversight. Our team emphasized that not only are we responsible for maintaining the integrity of our technology, we take on the burden of communicating with respective state agencies when necessary.

For example, if a customer made a change within their state tax account, or the state made a filing frequency change, it might require outreach to the state tax authority. Our team manages this communication on behalf of the user, taking another element of compliance off their plate.

Additionally, when states make sales tax laws changes, they are often hidden in lengthy sales tax legalese, and not easy to decipher. At TaxJar, we have a team dedicated to reviewing state tax laws and implementing changes within our sales tax engine, so our customers remain compliant. As regulations vary widely from one jurisdiction to another, an automated system can only go so far without expert supervision.

A partnership for compliance success

Our team noted that “every sales tax change that is made requires a partnership between technology and humans.” For instance, when Louisiana recently updated their shipping taxability from exempt to taxable, the change was buried in legislative updates. Our team manually reviewed and implemented the necessary adjustments to the automated system.

When state tax technology updates are slow, our team does everything they can to ensure that users remain fully supported by leveraging their knowledge and experience. An example is when states update their state tax filing portals, but the state roll out has hiccups or delays. Our team stays on top of the updates and ensures we file manually when necessary, to make sure our users aren’t hit with any late fees or penalties.

Transitioning to automation

For companies currently relying on manual filing methods, the transition to automation may seem daunting but is necessary for efficiency. Transitioning to an automated system is an investment that can pay off significantly in terms of time and accuracy.

Building an in-house sales tax function isn’t feasible for many businesses, especially small and medium-sized enterprises. By outsourcing compliance to experienced professionals who use automation tools, companies can ensure accurate and timely filings without the burden of managing the complex tax landscape themselves.

Ready to automate your compliance? Sign up for a free trial of TaxJar today.