How to collect sales tax through Square

by November 24, 2024

Here at TaxJar, we’re thrilled that we can help Square merchants easily track and file sales tax. But if you’re new to Square or TaxJar (or both!) here’s what you need to know about setting up sales tax collection.

How to set up sales tax collection through Square

Note: These instructions are for setting up sales tax in Square from a web browser. For directions on setting up sales tax in Square on a mobile device, go here.

1. Login to your Square dashboard and click the Items tab.

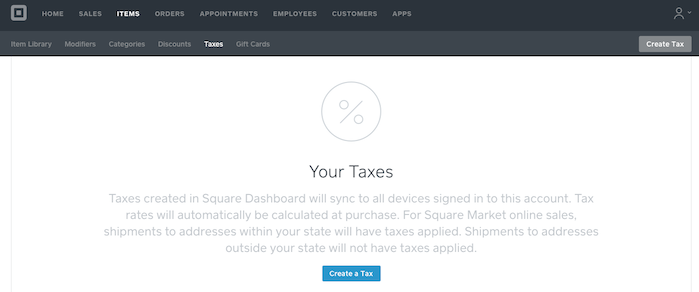

2. Click the “Taxes” tab and then “Create Tax” in the top right-hand corner or in the bottom center.

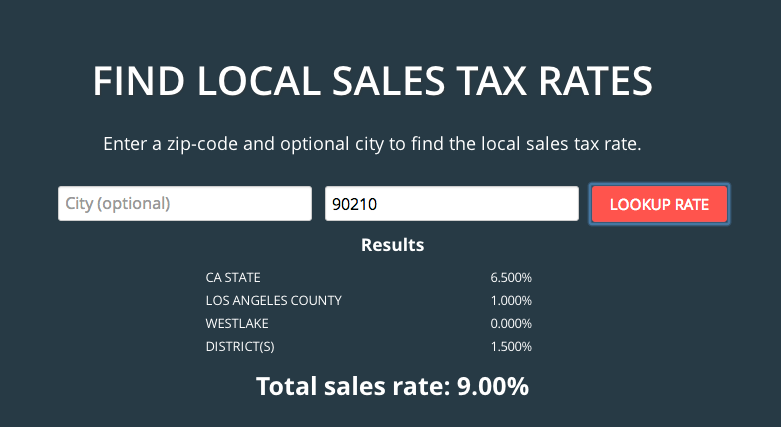

3. Find your local sales tax rate.

Note: Here’s where things start to get a little trickier, and the next steps of the automation process may look different for each business. wWe’ll walk you through different scenarios where you may use Square Register. If you normally sell in one place, such as in a brick- and- mortar store, then you may only have to set up one tax. To find out the tax rate at your location, enter your zip code into our Sales Tax Calculator.

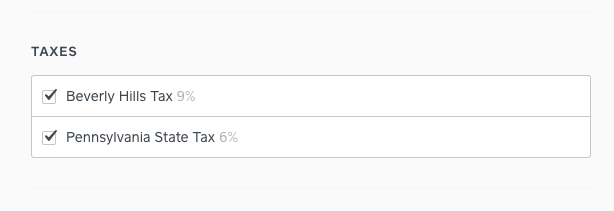

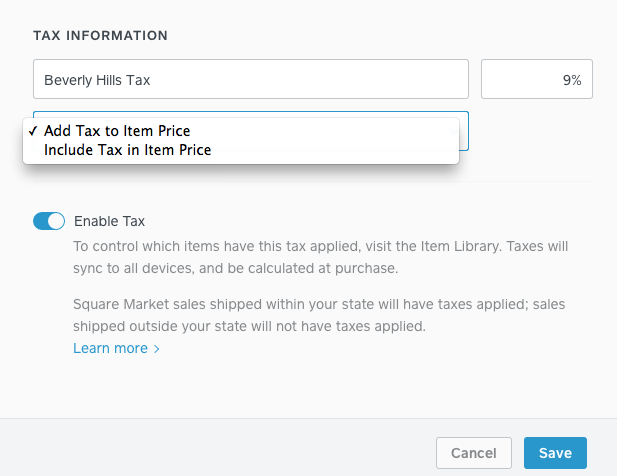

4. Set up your tax, name it, and set the tax rate.

To set up your first tax, name it (i.e. Beverly Hills Tax) and then set your tax rate. From here, you can decide if you want the tax included in the price of the item or if you want to add the tax to the item price each time. If you plan to display your prices, such as on a website, we recommend choosing the “Add Tax to Item Price” option and including the tax separately. Adding the tax to the price of the item online may make your prices appear higher than a competitor’s’ and cause you to lose a sale. When you’re finished, click save.

5. Use the “Item Library” to set tax-exempt status.

Note: Some items you sell may be tax-exempt. If that’s the case, just go to your “Item Library” and uncheck the tax box for any tax-exempt items.

6. Set up tax rates in all states where you have nexus.

Like we said above, If your business only sells out of one location or place, then you likely only need to collect one sales tax rate. But if your business is mobile or moves around – such as selling at craft fairs – or you sell online and have sales tax nexus in multiple states, you may find that you need to set up more than one tax rate. Follow the same steps above to set up as many sales tax rates as you want within Square. Then, go back to your “Item Library” and make sure the boxes next to all taxes you wish to charge are checked on each item.

You can also add the sales tax rate where you stand. This is incredibly convenient if you are selling on-the-go at a craft fair, trade show, or in a food truck.

How TaxJar works with Square

TaxJar keeps track of how much sales tax you collected in each taxing jurisdiction to make your sales tax filing simple.

In order to determine the correct jurisdiction in which a transaction occurred, TaxJar assesses two things. First, we look to see if you assigned a tax to the transaction in Square. If the transaction is associated with one of these taxes, we’ll use the city and zip you provided when you set up your TaxJar account. If the transaction does not have a tax jurisdiction assigned to it, we default to your business address as the location.

Example: If you associated the above “Beverly Hills Tax” with your item, then TaxJar assumes you made the sale in Beverly Hills, CA and categorizes it accordingly. But if you haven’t assigned any tax to an item and the item is taxable, then we use the home address you provided for your business.

So, if you actually live and run your business out of Tempe, Arizona, then we assume the sale was made in Tempe at their 8.10% sales tax rate. From here, we compile your sales tax collected into return-ready reports, saving you five hours per month on average. Or we can even AutoFile your sales tax returns in every US state.