Does your e-commerce business need a registered agent?

by December 12, 2024

Chances are you might be familiar with the phrase “registered agent,” but unsure as to what the service does, who can act as an RA, and whether or not your e-commerce business needs one. We’ve pulled together a quick primer on everything to know about registered agents (but might have been afraid to ask about).

What’s a registered agent and what do they do?

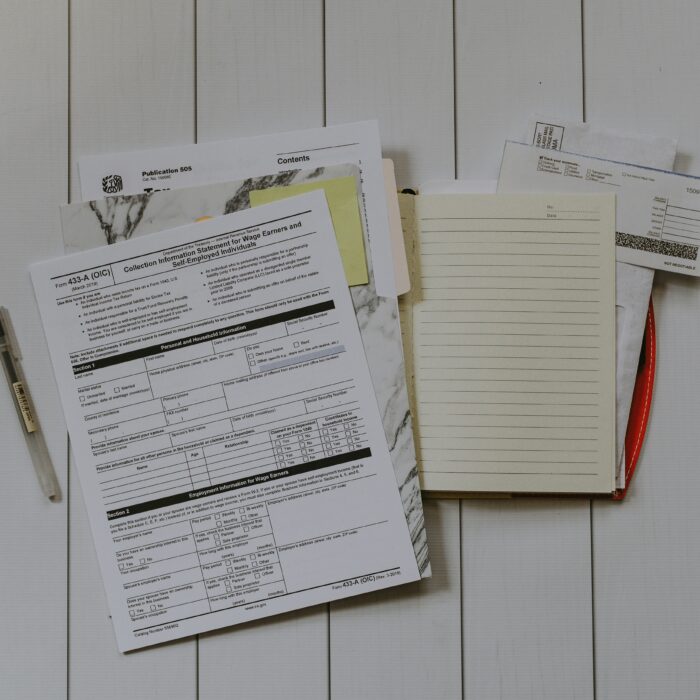

Registered agents are individuals or companies designated by incorporated businesses to accept official documents on behalf of the business. Basically, they’re your point of contact between your business and the state. Some of these documents can include general paperwork like annual reports and franchise tax forms or more serious official documentation like legal notices or a court summons.

Having a registered agent provides your company with an extra layer of privacy. Instead of being publicly served with the documents, which can ruin your reputation, RAs discretely accept the paperwork for you. They organize it accordingly and then pass it along, which provides an added peace of mind that nothing important falls through the cracks.

What kinds of e-commerce businesses need one?

Did you incorporate as an LLC, Corporation, or C Corporation? If so, your business is required by the state to have a designated RA to remain complaint with state law. If you don’t have one or put off designating an RA for longer than necessary, you may fall out of compliance. This can result in incurring penalties on your eCommerce business and even having the jurisdiction revoke your legal status.

Who can act as an RA?

You can enlist the services of a third party or even become a registered agent yourself! Here’s a look at some of the requirements.

If you bring on a third party: You can work alongside either an organization or an individual. The third party you work with must be reliable, have an understanding of what they’re doing, and able to help you keep track of legislative changes and requirements in the state. The third party individual or organization that you work with must have a physical address within the state you do business in, should be available to reach during general business hours, and a current resident of the state, too.

If you decide to become your own RA: Much like a third party registered agent, you will need to have a physical address, be a resident of the state you do business in, and have availability during general business hours. However, while acting as your own RA can save you a bit of money it can be difficult to figure out some of these details. You may not be available to receive paperwork during the hours specified or unable to figure out which address — whether your own personal one or business location — to designate. If you find this issue affects you, it’s best to work alongside a third party instead.

Please note: This blog is for informational purposes only. Be advised that sales tax rules and laws are subject to change at any time. For specific sales tax advice regarding your business, contact a tax advisor.

This post is from our friends at MyCorporation.