Filing sales tax returns when no tax was collected

by January 5, 2025

A common sales tax scenario goes like this: You started your business, or perhaps established sales tax nexus in a state, but didn’t realize you had to collect sales tax until a little later. Now you’ve found yourself in a situation where you didn’t collect any sales tax from your buyers (or only belatedly began collecting), but the state wants you to remit sales tax all the way back to your business’s start date.

We’ve found that TaxJar customers run into this fairly often. Here are our tips for how to handle filing a sales tax return even if you didn’t collect any sales tax.

Tips for filing a sales tax return when you haven’t collected sales tax

Determine your taxable period

First, figure out the dates in which you should have collected sales tax from your customers. For example, say you started your Florida-based business on January 1, but didn’t realize you needed to register for a sales tax permit until January 31st. When you went to register for your sales tax permit and told your state you started your business on January 1, they’ll want the sales tax you should have collected for the month of January (but didn’t.)

Once you’ve determined your taxable period, be sure to follow these directions and make sure that matches your state settings in TaxJar.

Check your “Expected Sales Tax Due” report

So you should have collected sales tax from your buyers in Florida between January 1 and January 31st, but you didn’t. Your options are to either figure out how much you should have collected and go back and ask your customers for the sales tax or figure out how much sales tax you should have collected and remit that amount out of your pocket. While, at TaxJar, we never want to see sellers paying sales tax out of pocket, sometimes it’s the lesser of two evils.

To determine how much sales tax you should have collected, login to TaxJar and check your “Expected Sales Tax Due” report for your state (Florida, in this case.)

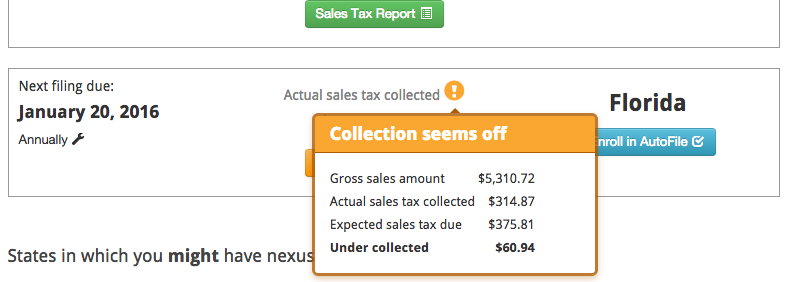

On your TaxJar dashboard, we’ll show you the states where it looks like you collected too little (or too much) sales tax:

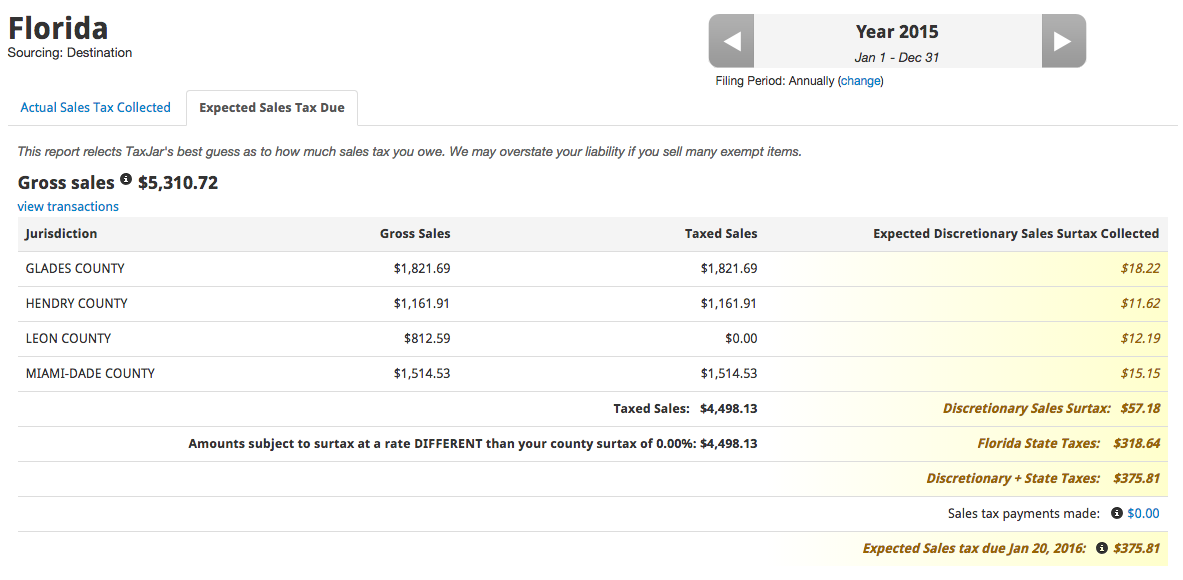

If you click on the state and the “Expected Sales Tax Due” tab, we’ll show you where your sales tax collection is off broken down by jurisdiction:

TaxJar will show you how much you should have collected from your buyers if you had been collecting sales tax. The report will show you this info broken down by county, but you can also view individual transactions in your Detailed Sales Tax Analysis Report.

Now you’ll know how much you should have collected, but didn’t. And you can use this information to…

File your sales tax return

You can use the information on your Expected Sales Tax Due report to file your sales tax return. You can see step-by-step instructions here on “How to Use TaxJar to File Your Sales Tax Returns.”

TaxJar can also AutoFile your sales tax returns for you in most states, though – since we won’t show you’ve collected any sales tax- you’ll need to set your TaxJar account to treat all sales as taxable during your AutoFile enrollment process.

Other considerations

Now that you’ve filed your sales tax returns, there are a few things to consider:

Set up sales tax collection

If you had to use TaxJar’s “Expected Sales Tax Due” report to file your sales tax return, double check to make sure that you are now collecting sales tax from your buyers on all of the platforms you sell on. This will help you avoid paying sales tax out of your pocket in the future.

Evaluate your nexus and register for all the sales tax permits you need

To avoid having to go through this again the future, evaluate where you have sales tax nexus and make sure you are registered for a sales tax permit in those states. That said, you may want to wait and register when you are more established in a state, even though you have nexus. We’ve written a great blog post and whitepaper to help sellers determine when to register for a sales tax permit.

Owe more sales tax than you can pay? Know your options

Do you owe a great deal of back sales tax? This can happen all too easily. Maybe you didn’t realize that you had sales tax nexus in a state over a long period of time and owe thousands of dollars plus ever increasing interest and penalties. If this is the case, you can look into working with a CPA or tax attorney on a “voluntary disclosure agreement.” If you go this route, a sales tax expert will work on your behalf to negotiate paying the back sales tax you owe. They may be able to help you mitigate the interest and fees you would pay if you paid the back sales taxes yourself.

Ready to automate sales tax? To learn more about TaxJar and get started, visit https://www.taxjar.com/product.