How to file a Kentucky sales tax return

by November 1, 2024

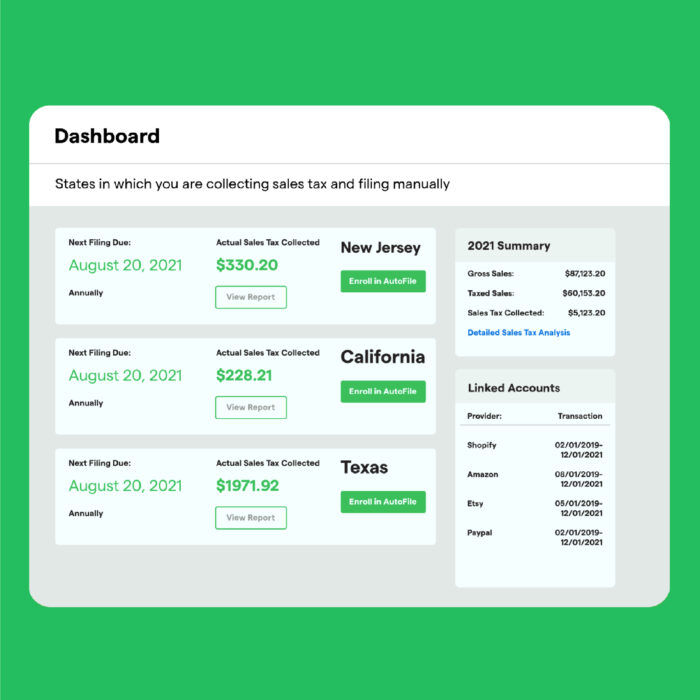

Kentucky doesn’t make it easy to file sales tax returns, which is why we created TaxJar. TaxJar’s state reports simplify the process of filing a return and can save you hours spent on managing sales tax. We wrote this post as a step-by-step guide for using TaxJar’s report to fill in the info you need to file your Kentucky sales tax return.

What you’ll need to file a Kentucky sales tax return

In order to file your sales tax return, it’s important to gather a few key documents and pieces of information.

Every state has specific requirements. Generally, we recommend:

- Your TaxJar Kentucky sales tax report

- Your Kentucky sales and use tax account number

- Your state-assigned filing frequency

- Your Kentucky electronic filing login details (ie: username, password, etc)

- Your bank account number and routing number that you’d like to use for sales tax payment

Note: In some states, you’ll need additional verification pieces like a Letter ID (ie: Hawaii), an identification number (ie: Kansas) a limited access code (in California), etc. Be prepared to take a few extra steps to ensure your account is secure.

Once you’ve gathered the items above, you’re ready to file your return.

Steps to manually filing a sales tax return in Kentucky

- Open your TaxJar Report for Kentucky

- Select the Record Filing button at the top of your report

- Use the links on the top right to locate the state’s filing website or download a paper form

- Copy the information from your TaxJar Kentucky Report into the state’s website. View detailed instructions on using TaxJar Reports to file a return including a note on how to file when Marketplace Facilitator Tax collected

- Remit payment directly with the state

- Record your filing & payment with TaxJar for organized sales tax records and easy-access at a later date

State resources to help you file your return

Kentucky knows that filing a sales tax return can be hard, so they provide resources to business owners to help teach you how to file.

Kentucky state information

Need more help?

We get it. Sometimes it just helps to talk to someone. At TaxJar we provide general education, but we’re not CPAs. As much as we’d like to help, we aren’t able to give specific recommendations or advice for your business. However, we’re pleased to connect you with one of our recommended sales tax partners.

We maintain a list of vetted sales tax experts that can help with all things sales tax from registration assistance to general consulting and advice. These partners are familiar with the ins and outs of e-commerce sales tax and are here to help you.

How TaxJar can help

As you can see, sales tax compliance is challenging. There are so many important details that businesses must be aware of to stay compliant and avoid penalties. TaxJar can make compliance easier, by managing all the different aspects, including keeping you updated on where you have nexus, registering for sales tax permits, and automating sales tax filing and remittance. To learn more about TaxJar and get started automating your sales tax compliance, start a free, 30-day trial today.