I only sell on marketplaces. Can I cancel my sales tax permits?

by March 1, 2025

One question we often receive at TaxJar is “I only sell on marketplaces like Amazon or eBay. Now that so many states have marketplace facilitator laws, does that mean I can cancel my sales tax permits?”

This post will explain what marketplace facilitator laws have to do with sales tax permits, and delve into which states have stated a position on whether or not marketplace sellers are still required to maintain state sales tax permits.

A note of caution: This blog post is for informational purposes only, and talks about a fast developing situation. We always recommend speaking with the state’s taxing authority or a vetted sales tax expert before making a major change to your business’s sales tax compliance.

What are marketplace facilitator laws?

Until recently, most e-commerce businesses with sales tax nexus in a state were required to collect sales tax from buyers whether they sold on their own website such as through Shopify, WooCommerce, Magento or an ERP, or on an online marketplace like Amazon, eBay, Etsy or Walmart.

But, now most states have passed marketplace facilitator laws. These laws require that marketplaces like Amazon, etc. collect sales tax on behalf of 3rd party sellers who make sales on the platform.

You can learn a lot more about marketplace facilitator laws, and see which states have marketplace facilitator laws, in our State by state: Marketplace facilitator laws explained post.

What changed for e-commerce businesses when marketplace facilitator laws went into effect?

The biggest change, of course, was that e-commerce sellers were no longer required to collect sales tax when selling via an online marketplace.

But this also led to some confusion. Even though marketplaces are now collecting sales tax in many states on behalf of e-commerce businesses, this doesn’t mean that e-commerce businesses can forget about sales tax altogether.

For example, businesses are still required to collect sales tax in states where they have nexus in many scenarios, including when they:

- sell on their own online store (like via Shopify or WooCommerce)

- sell at a brick and mortar store

- sell on a marketplace that is not required to collect sales tax on their behalf

- sell at trade shows, craft fairs or other non-marketplace venues

To further confuse matters, some states still require marketplace sellers to report how much sales tax was collected on their behalf and file sales tax returns. And that’s even if they only sell on marketplaces.

To sum it up, just because your business only sells via marketplaces like Amazon, that doesn’t mean that you should immediately cancel all of your sales tax permits.

Can 3rd party marketplace sellers cancel their sales tax permits?

As states began releasing guidance on marketplace facilitator laws, they also began releasing guidance for how they want marketplace sellers to handle sales tax in their state.

The below list is what we have determined from the states when it comes to whether sellers who are currently registered for a sales tax permit with a state can cancel their sales tax permit if they only sell via marketplaces.

It’s important to note that this post is only for sellers who are already registered in a state.

Also, this post doesn’t apply to sellers who sell on marketplaces and other venues (brick and mortar, online stores, etc.) In other words, if your e-commerce business gives you sales tax nexus in a state, and you sell online via non-marketplace channels, your business is still required to be registered for a valid sales tax permit and collect sales tax in your nexus states.

Before making a sales tax decision, be aware: This blog post is for informational purposes only, and talks about a fast developing situation. We always recommend speaking with the state’s taxing authority or a vetted sales tax expert before making a major change to your business’s sales tax compliance.

*If a state isn’t on the list, it means they don’t have a Marketplace Facilitator law on the books yet. These states currently include Florida, Kansas, Louisiana, Mississippi and Missouri. As of this writing, Tennessee has passed a Marketplace Facilitator law, but it doesn’t go into effect until October 1, 2020. (Update: Louisiana and Mississippi’s Marketplace Facilitator Laws went into effect July 1, 2020.)

Alabama – Yes, you can cancel your Alabama sales tax permit. Please call the state’s sales tax department at 334-242-1490 to close any accounts that are no longer needed.

Arizona – Yes, you can cancel your Arizona TPT permit if you meet certain conditions.

If you are a marketplace seller and only sell through a marketplace facilitator, you may cancel your license after receiving an exemption certificate, or other proper documentation, from your marketplace facilitator. Arizona has provided Form 5020 here that marketplace sellers can use to obtain proper documentation from the marketplaces on which they sell. This form is required to be completed by the marketplace facilitator (e.g. Amazon). (Read “I’m already licensed and filing as a marketplace seller. What do I need to do after October 1, 2019?”)

Arkansas – No, marketplace-only sellers should not cancel their sales tax permits. Businesses already registered for a sales tax permit should remain registered, even if they only sell via marketplaces.

California – Yes, you can cancel your California sales tax permit. According to the CDTFA: “Yes, beginning October 1, 2019, you are not required to be registered as a retailer with the CDTFA if all of your sales of tangible merchandise are facilitated by marketplace facilitators who are the retailers for purposes of those sales.” (See “Marketplace Sellers’ Requirements” here.)

Colorado – No. Per the state, a marketplace facilitator making or facilitating retail sales of tangible personal property, commodities and taxable service in Colorado must first obtain a retail sales tax license. Read more information for Marketplace Sellers in Colorado here.

Connecticut – No, marketplace-only sellers should not cancel their sales tax permits. However, they can request to change your filing status to annual by sending a secure email message to Connecticut Department of Revenue Services through the online Taxpayer Service Center (TSC). (Read guidance from the Connecticut DRS here.)

District of Columbia/Washington DC – DC has not issued guidance. Contact the District to determine if you can cancel your permit. Find more information here.

Hawaii – No, marketplace sellers should not cancel their GET licenses. Hawaii’s tax is a “general excise tax” rather than a sales tax, and the state still requires that marketplace sellers retain their GET licenses. (Source)

Idaho – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Illinois – No, marketplace-only sellers should not cancel their sales tax permits if they have sales tax nexus in Illinois. (Source)

Indiana – Yes, you can cancel your Indiana sales tax permit. Indiana allows marketplace-only sellers to elect to either cancel or maintain their Indiana sales tax permit. (See “How does this Impact Sellers on a Marketplace?”)

Iowa – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit. See more information for Marketplace Sellers in Iowa here.

Kentucky – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit. See more information for “Marketplace Retailers” in Kentucky here.

Louisiana – No, marketplace-only sellers should not cancel their sales tax permits.

Maine – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Maryland – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Massachusetts – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

Michigan – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit. Read more information for Marketplace Sellers in Michigan here.

Minnesota – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Mississippi – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

Nebraska – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Nevada – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

New Jersey – While non-marketplace sellers are not permitted to cancel sales tax permits, they can contact the state and ask to be put on a “non-reporting” basis. Read more information for Marketplace Sellers in New Jersey here.

New Mexico – No, marketplace-only sellers should not cancel their New Mexico gross receipts tax registration.

New York – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

North Carolina – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit. Read more information for Marketplace Sellers in North Carolina here.

North Dakota – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Ohio – Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

Oklahoma – Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

Pennsylvania – No, marketplace-only sellers should not cancel their sales tax permits.

Rhode Island – No, marketplace-only sellers should not cancel their sales tax permits.

South Carolina – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit. Read more information for South Carolina marketplace sellers here.

South Dakota – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Tennessee – This state has not issued guidance. Marketplace only sellers should contact the state to determine if you can cancel your sales tax permit.

Texas – Yes, marketplace-only sellers can ask to cancel their Texas sales tax permits by filling out Form 01-798 (opens in PDF). (Source)

Utah – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Vermont – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Virginia – Yes. Marketplace-only sellers can fill out Form R-3 to mark themselves as “No longer liable for sales tax.” (Source)

Washington – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

West Virginia – No, marketplace-only sellers should not cancel their sales tax permits. (Source)

Wisconsin – No, marketplace-only sellers should not cancel their sales tax permits.

Wyoming – No, marketplace-only sellers should not cancel their sales tax permits.

My state doesn’t allow me to cancel my sales tax permit. Now what?

As with all things sales tax related, each state is slightly different in this regard. Some states, like Connecticut, allow marketplace-only sellers to file sales tax less frequently.

Other states, like Washington, still want marketplace-only sellers to file as usual. (This is partly because Washington requires businesses to file Business & Occupation tax along with sales tax.)

No matter what your state is telling you, if you hold an active sales tax permit, you should continue to file your sales tax returns by the state mandated deadline.

How to file can also be confusing. Some states want you to report your marketplace sales on your sales tax return as usual. The only difference is that the marketplace itself collects and remits the actual tax.

Other states want you to omit your marketplace sales, or simply file “Zero” returns with no sales tax collection shown.

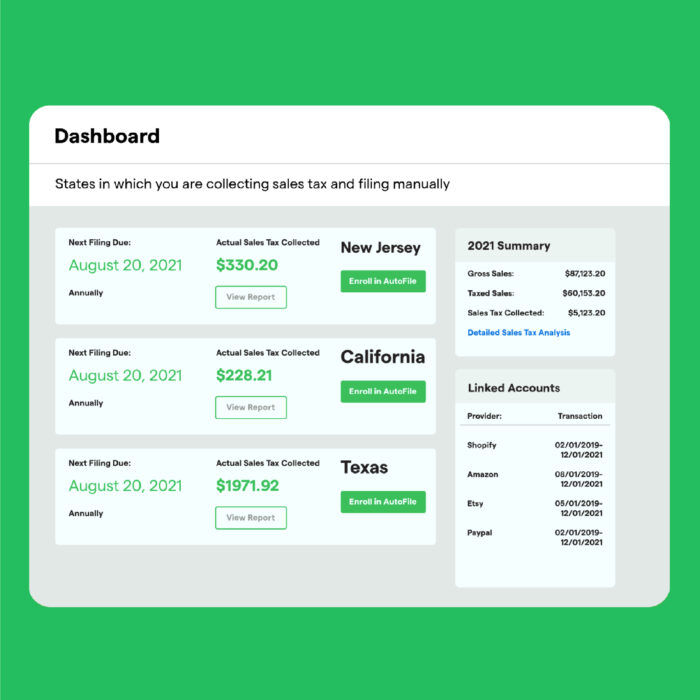

TaxJar is here to help. Whether you are a marketplace-only seller, or have the much more difficult job of splitting up your marketplace and non-marketplace sales, TaxJar AutoFile files the right amount of sales tax, the way the state wants to see it, every time.

Ready to automate sales tax filing? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.

Current registrations vs. future registrations

Confusingly, many states have provided guidance that businesses that a) only sell through marketplaces and b) who meet the requirements for sales tax nexus after a marketplace facilitator law goes into effect are not required to to register for a new sales tax permit.

However, they also state that businesses that only sell through marketplaces but that are already registered for a state sales tax permit should remain registered. Their wording is often: “This new marketplace facilitator law does not impact the sales tax license obligations for existing registered remote sellers.”

Why is this? Basically, if you already have a relationship (i.e. a sales tax registration) with a state, that state wants to maintain that relationship. For them, the chance to generate future sales tax revenue from any registered businesses is a powerful motivator.

However, if you find that you are only making marketplace sales and are frequently filing zero returns, we recommend that you contact the state. Even the oldest marketplace facilitator laws are still only a couple of years old, and states are still wrapping their heads around administration.

As you can see from the list above, many states have either not released any guidance at all for marketplace sellers, or expect marketplace sellers to remain registered and file sales tax returns, even though marketplaces are now collecting on their behalf.

As states become more experienced with “the new normal” they may allow more sellers to cancel sales tax permits.

A final note: it’s important to assess your business before making a decision about cancelling sales tax permits. Are you in a growth stage? Do you plan to expand and think you may move beyond just selling on marketplaces in the future? Then you may want to hang on to your sales tax permit rather than cancelling it and going through the administrative hassle of registering again in the future. This business decision is up to you.

Every state is handling sales tax administration around marketplace facilitator laws in their own way. Some allow marketplace-only sellers to cancel sales tax registrations, some require that marketplace-only sellers remain registered, and still others have not come out with any formal guidance either way.

As always, we recommend checking with the state or a vetted sales tax expert before making the business decision to cancel a sales tax permit.