Top five tips for navigating a busy sales tax filing month

by September 15, 2025

Every so often, e-commerce sellers are faced with a busy filing month. Because state filing frequencies vary between monthly, quarterly, bi-monthly, and annual, there are certain times of the year when all the filing frequencies align and almost all sellers have sales tax due.

For businesses filing in multiple states, these months can be challenging. The rush of a busy month can leave even the most organized business owner feeling overwhelmed.

Effective preparation and strategic management are key to successfully navigating the complexities of sales tax compliance. Here are our top tips to help you sail through this hectic time with confidence.

1. Understand your filing requirements

Navigating these busy filing months starts with understanding where you have sales tax obligations based on where you have sales tax nexus. There are two different types of sales tax nexus, or in other words, two different ways you can meet the requirements to collect and remit sales tax to a state. Physical nexus is just that, a physical connection to a state. Common examples of physical nexus (also sometimes referred to as “physical presence”) include employees, offices, stores, warehouses, conference attendance, or servers.

Then there is economic nexus. These are either revenue or transaction (or both) thresholds that require businesses who exceed these thresholds to collect sales tax from buyers in that state. For example, in the state of Georgia, businesses only need to collect sales tax from customers if they have exceeded $100,000 in revenue or 200 transactions from customers in Georgia. These thresholds vary from state to state. As you increase sales in more states, you might reach a new threshold, so it’s important to check in on your sales tax obligations throughout the year.

2. Start early

To successfully navigate a busy sales tax filing month, proactive preparation is key. Avoid the common pitfall of last-minute scrambling by beginning your preparation well in advance. This involves more than just a quick glance at your figures; it requires a meticulous process of gathering and reviewing all your sales data.

Ensure that every transaction is accounted for and accurately categorized, as any discrepancies can lead to costly errors. By taking the time to organize and verify your information long before the filing deadline, you significantly reduce the risk of errors and ensure completeness, allowing for a smoother, more efficient filing process.

It can help to create internal deadlines for preparing your filings a few days before the official due date. This buffer helps account for any unexpected issues.

3. Be diligent with exemption certificates

It’s crucial to verify that all exemption certificates for eligible sales are current and valid. Out-of-date or missing certificates can result in penalties. Regularly review and update your exemption certificate records to avoid potential issues during audits. Implementing a system for tracking expiration dates and proactively requesting renewed certificates from customers can greatly mitigate this risk.

A well-structured system for organizing and storing exemption certificates is important for efficient operations and audit readiness. A streamlined process ensures that you can quickly retrieve and reference certificates when needed, saving valuable time and reducing stress during sales tax filing or an audit.

Consider using sales tax compliance software to assist with the management of exemption certificates, as many platforms include a feature to help with this. For example, TaxJar customers on the Professional plan can upload and store customer exemption certificates in their TaxJar account, keeping all their sales tax data in one place. A solution like this can save you time and reduce the risk of errors.

4. Leverage technology

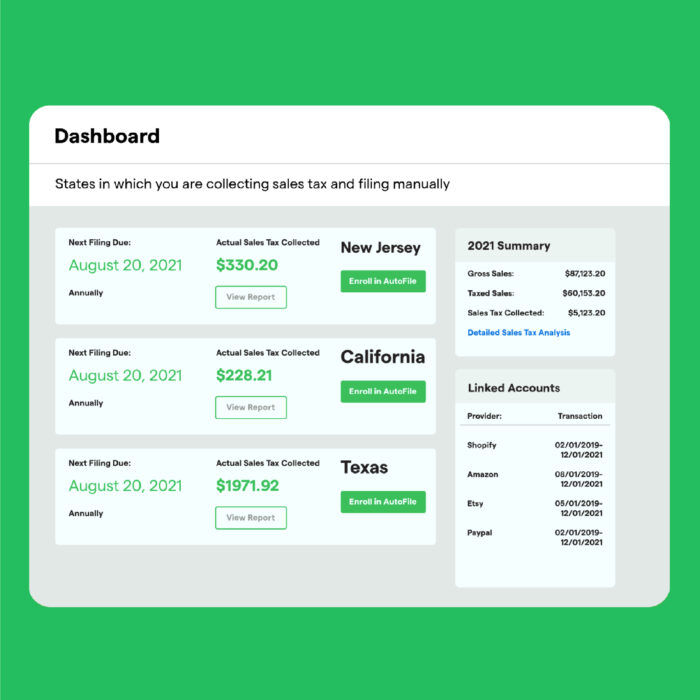

Consider integrating sales tax automation tools, such as TaxJar, into your compliance workflow. TaxJar is designed to streamline the entire sales tax process, from calculation to filing, significantly reducing the manual effort required.

By proactively adopting sales tax automation, businesses can transform a potentially overwhelming task into a seamless and efficient process, freeing up valuable resources and ensuring compliance.

In addition, sales tax software generally has the option to enroll in automated filing features that handle submissions directly to the necessary state authorities. Tools like these reduce your workload and stress, especially during busy filing months. TaxJar’s AutoFile is a great option for businesses and is trusted by e-commerce businesses across the US. In fact, in 2024, TaxJar filed 640,000 timely sales tax returns, remitting $1.3 billion to state tax authorities, all backed by our accuracy and filing guarantee.

5. Stay informed about regulatory changes

Sales tax laws are not static; they are subject to frequent revisions and updates at the state and local levels. In 2025 alone, there have been over 400 sales tax rate changes, and 50 updates to product taxability. These changes can significantly impact how businesses are required to collect, calculate, and report sales tax. With that in mind, a proactive and informed approach is crucial for maintaining compliance and avoiding potential penalties.

It’s important to keep in mind that sales tax laws vary significantly by jurisdiction. A change in one state or city may not apply to another. Businesses operating in multiple jurisdictions must be particularly diligent in tracking and understanding the specific regulations relevant to each location where they conduct sales.

Handle busy filing months with ease

Navigating a busy sales tax filing month doesn’t have to be a daunting task. By implementing these tips and staying organized, you will ensure a smoother compliance process. Remember, early preparation, leveraging technology, and staying informed on sales tax changes can significantly reduce stress during these hectic months.

If you’re ready to automate your compliance, TaxJar is a great tool for businesses looking to streamline their compliance processes, giving them back hours each month while ensuring accuracy.

Our tool automates the entire process, from nexus monitoring to reporting to automated filing and remittance. TaxJar stays on top of sales tax changes, so you are always compliant, even when laws are updated.

Our 30-day free trial gives you the opportunity to see how TaxJar can support your compliance goals and allow your company to continue to grow without sales tax management slowing you down.

If you’d like to learn more about how TaxJar can help support your compliance goals, feel free to schedule a time to chat with our sales team here.