Is shipping taxable in Ohio?

by December 29, 2024

When dealing with sales tax, one question merchants often face is whether or not to charge sales tax on shipping charges. It doesn’t help that every state is different. Some want you to charge sales tax on shipping charges and others don’t necessarily require you to. Today we’ll look at how to handle sales tax on shipping in Ohio.

Is shipping taxable in Ohio?

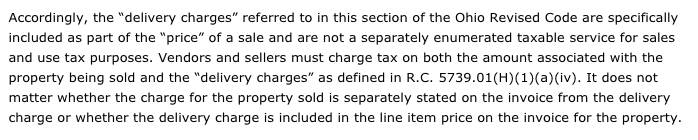

Here’s what the Ohio Department of Taxation has to say about sales tax on shipping:

In laymen’s terms, this simply states that Ohio considers shipping charges part of the price of the item and therefore taxable. So you, as a seller, should charge sales tax on the shipping price of an item.

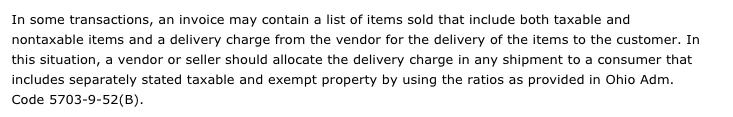

If the item you are shipping isn’t taxable, then don’t charge sales tax on shipping. If some items in a shipment are taxable and some are not, only charge sales tax on the portion of shipping charges related to the taxable item. Here’s what Ohio has to say:

Summary of Ohio shipping taxability

Ohio makes figuring out whether to charge sales tax on shipping fairly simple.

- If the item is taxable, charge sales tax on the shipping charges

- If the item is not taxable, don’t charge sales tax on the shipping charges

- If you are shipping a mix of taxable and non-taxable items, only charge sales tax on the portion of shipping charges allocated to the taxable item

For more about sales tax in Ohio, check out our Ohio Sales Tax Guide.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.