U.S. States Without Sales Tax: 2021 Update

by October 5, 2020

Here at TaxJar, we live and breathe helping online sellers handle sales tax compliance. But a few lucky online sellers don’t have to worry about sales tax. If you live and run your business out of the five U.S. states that do not have a sales tax – then sales tax may not be on your radar at all. As most other online sellers would likely say, “Lucky you!”

Here at TaxJar, we live and breathe helping online sellers handle sales tax compliance. But a few lucky online sellers don’t have to worry about sales tax. If you live and run your business out of the five U.S. states that do not have a sales tax – then sales tax may not be on your radar at all. As most other online sellers would likely say, “Lucky you!”

Knowing which states you don’t have to collect sales tax in is crucial, especially as we move into the holiday shopping season where you might find yourself selling in more states than usual. If you charge the wrong customer sales tax, you could be facing some bad reviews from upset customers. So it’s important to understand the five states without sales tax.

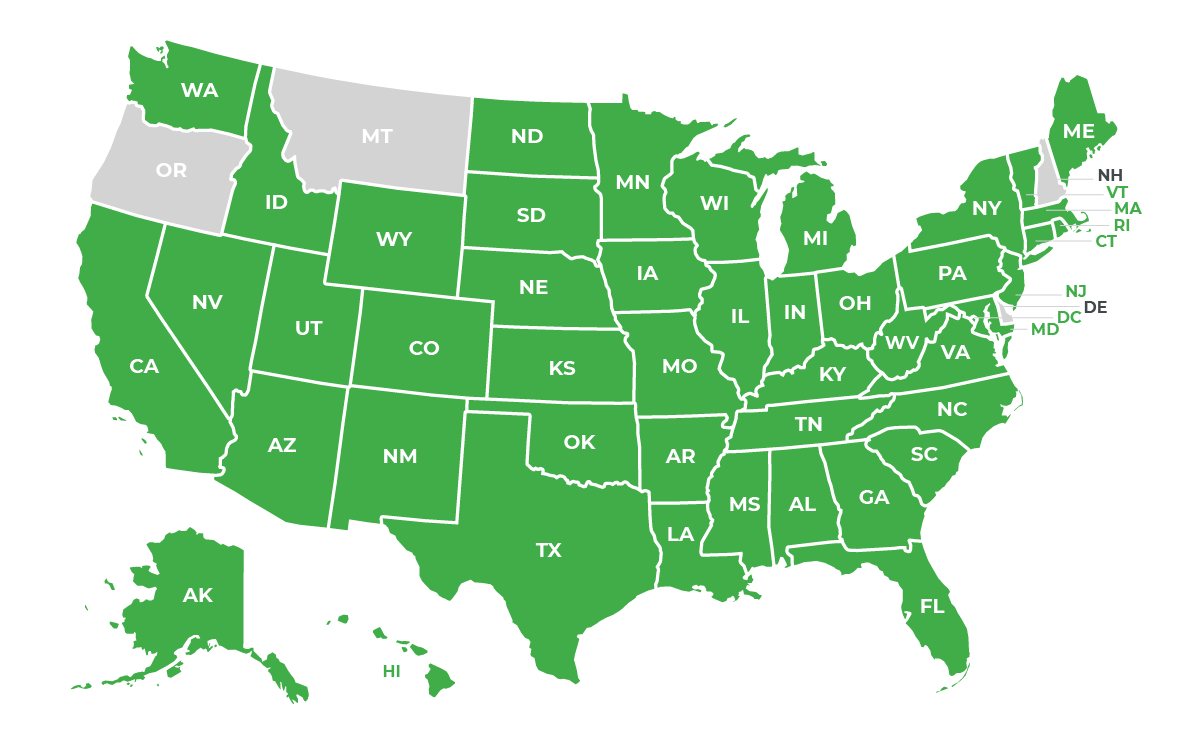

The four states without sales tax

-

- 1. Delaware

-

- 2. Montana

-

- 3. New Hampshire

-

- 4. Oregon

If you live and operate your business in one of these states, you don’t have to worry about collecting and remitting sales tax. Or, if you find that you suddenly have nexus in these states, don’t worry. It’s unlikely that you have to deal with tax here, too.

Of course, there’s one caveat. (With sales tax, there’s almost always a caveat!) Some local areas within these states may be able to charge a sales tax. While it’s less likely that you are responsible for one of these local sales taxes, you should always check with any state’s taxing authority when you find you have nexus in that state.

Don’t want to keep up with which states do and don’t have sales tax? Let TaxJar handle your sales tax remittance. Start your free trial today!