When to Register for a Sales Tax License

by August 30, 2017

Last updated July 13, 2018

There are three things we know to be true about sales tax:

1.) States where you have sales tax nexus require you to collect sales tax from buyers in those states

2.) States consider it unlawful to collect sales tax without a sales tax license

3.) You never know when you’ll make your first sale in a state where you have sales tax nexus. If you register too early, you may find yourself filing zero return after zero return. But if you wait to file, you may find yourself between a rock and a hard place deciding whether to collect sales tax when your permit hasn’t arrived yet.

So what’s a seller to do?

When to Register for a Sales Tax Permit

First off, if you sell taxable products, you’ll always have sales tax nexus in your home state – even if you operate your business from your kitchen table. We highly recommend that you register for a sales tax permit in your home state before you start doing business.

As for other states, at TaxJar we firmly believe that it’s up to you to make business decision and when you decided to register for a sales tax permit is firmly in your hands. We’re not here to tell you what to do, just to show you what other sellers are doing. This post is especially applicable to Amazon FBA sellers, because you have sales tax nexus in different states due to having inventory stored there.

Aside from your home/office and having inventory stored in an Amazon fulfillment center, here are other reasons why you may have sales tax nexus in a state:

- You have an office or other location

- You have an employee, contractor, or salesperson

- You have 3rd party affiliates

- You have economic nexus (either a certain dollar amount of revenue made or a certain number of sales transactions made in a state)

- You do business in a state for a limited amount of time, such as at a trade show or craft fair

We’ve talked to sellers who take three different approaches when it comes to when to register for you sales tax permit:

1.) The Extremely Conservative Approach – Some FBA sellers will start selling and immediately register for sales tax permits in all of the states where an Amazon fulfillment center is located, regardless of whether or not they have sales tax nexus there. Sellers who take this approach have told us that they just want to get it over with so they don’t have to deal with it later, or that they want to be very safe and already have a sales tax permit in hand as soon as they have inventory in another state.

This approach has significant drawbacks, though. If you don’t have nexus in a state, you aren’t obligated to collect sales tax from buyers in that state, so you may be collecting and filing where you don’t necessarily have to. In fact, you may never have nexus in some Amazon states, and then you’ve made administrative work for yourself for nothing. (The states where you’re collecting and remitting sales tax will be happy with you, though!)

2.) The Wait-and-See Approach (Recommended) – The vast majority of FBA sellers we’ve talked to take this approach. They register in their home state and then evaluate the other states in which they have nexus to determine whether or not to register. If they’re making lots of sales in a nexus state without collecting sales tax, they then register for a sales tax permit there. But if they’ve only made a handful of sales and only owe a small amount of sales tax, they may make the calculated business decision that waiting is worth the risk and put off registering.

Example: Let’s say you’re registered for a sales tax permit in your home state of North Carolina, and you only have inventory stored in Amazon fulfillment centers in two states: California and South Carolina. You’re trying to decide whether or not to collect sales tax in both of these states.

In this example, your products are selling like hot cakes in California and you’ve made $10,000 in sales there without ever collecting any sales tax. You run your numbers in TaxJar and see that you should have collected about $750 in California sales tax. You realize that these numbers could mean big financial trouble should the California BOE catch you failing to collect sales tax. So you decide to register for your California sales tax permit.

In the other hand, you only sold a couple of items in South Carolina and the sales tax you should have collected and remitted is about $10. You might choose to risk not registering and collecting in South Carolina because the amount you should have collected is so small. Even if South Carolina comes after you, you can easily absorb the fines and penalties involving this tiny amount of sales tax.

Also, if “Wait-and-See” sellers don’t have nexus in a state, they simply don’t register there. But they do keep a close eye on their inventory and, when they discover they have inventory in another state, they follow the same evaluation process described above.

Keep in mind that, on average, FBA sellers have inventory in 10 states – so you may have a lot of evaluating to do! TaxJar can help. We offer an “Expected Sales Tax Due” report so you can see how much sales tax you should have collected if you had been collecting in a state. This will help you evaluate whether or not it’s time to register for a sales tax permit.

3.) The Bury-Your-Head-in-the-Sand Approach – The other approach we see is when sellers just bury their head in the sand and hope this whole sales tax nexus thing will go away. Some sellers don’t believe that other states can legally come after them, despite sales tax nexus laws in each state. Others are paralyzed by the state’s paperwork and legalese when it comes to registering and getting started. Others think that federal legislation like the Marketplace Fairness Act (MFA) or the Remote Transaction Parity Act (RTPA) will make this easier. (When, in fact, both of these current internet sales tax bills would make life significantly harder for online sellers.) Whatever the reason, this approach isn’t the answer. It can lead to fines, penalties and lots of headache.

What is an online seller to do in this situation?

Scott Scharf of Catching Clouds wrote a whitepaper for TaxJar on the ideal time to register for a sales tax permit.

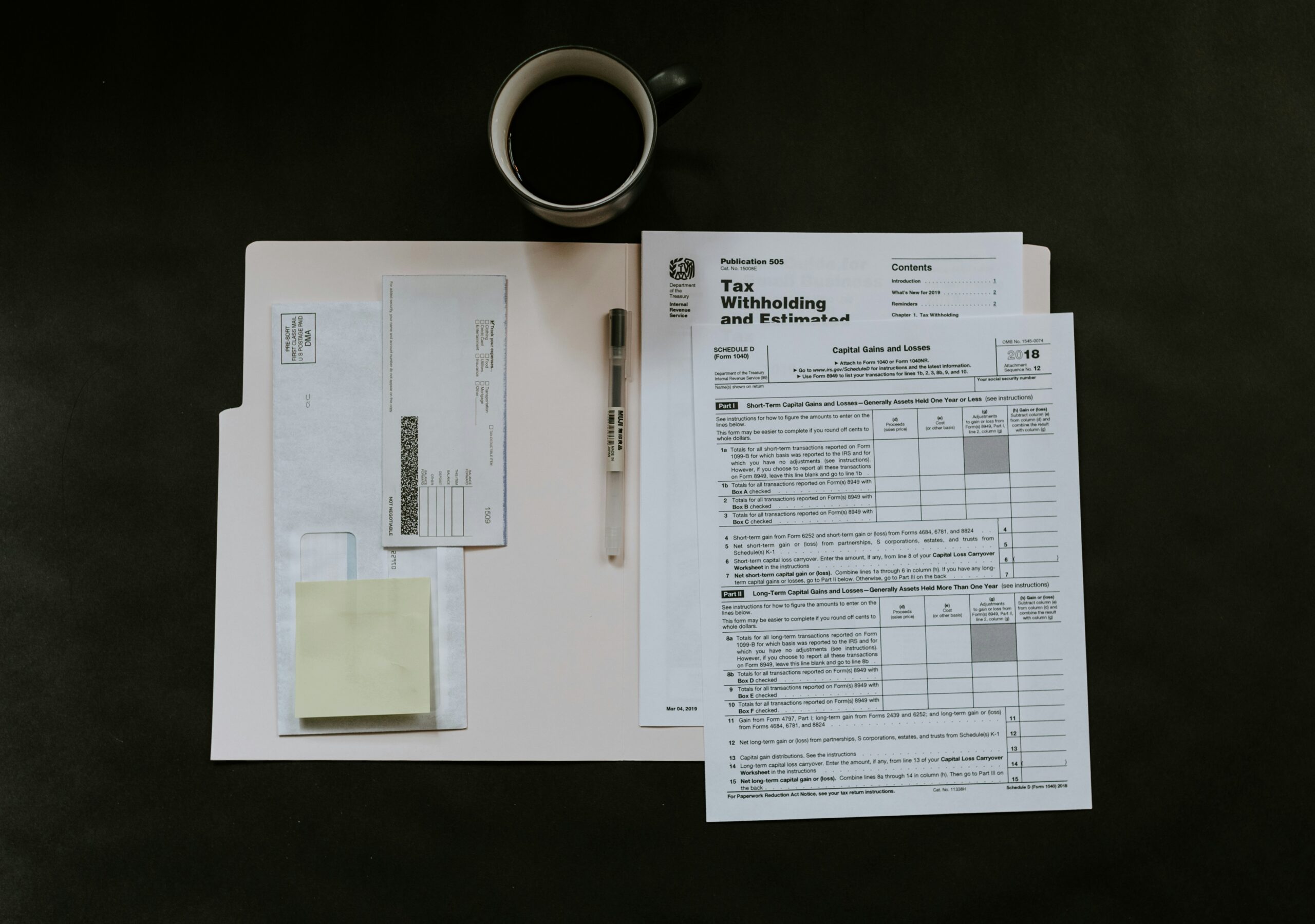

This quick guide on when (and when not) to register for a sales tax license includes:

- How to determine where your business has sales tax nexus

- How to determine what date your sales tax nexus started

- How to determine how much you owe in each state

- An important concept — “Materiality” — and why it matters when you go to register for a sales tax permit

- The date you should enter on your sales tax registration forms

- A handy matrix to help you determine when to register for a sales tax license

Have you ever wondered if it’s time to register for a sales tax permit in a certain state? Learn more in our whitepaper, “When to Register for a Sales Tax Permit.” And to learn more about TaxJar and get started, visit TaxJar.com/how-it-works.