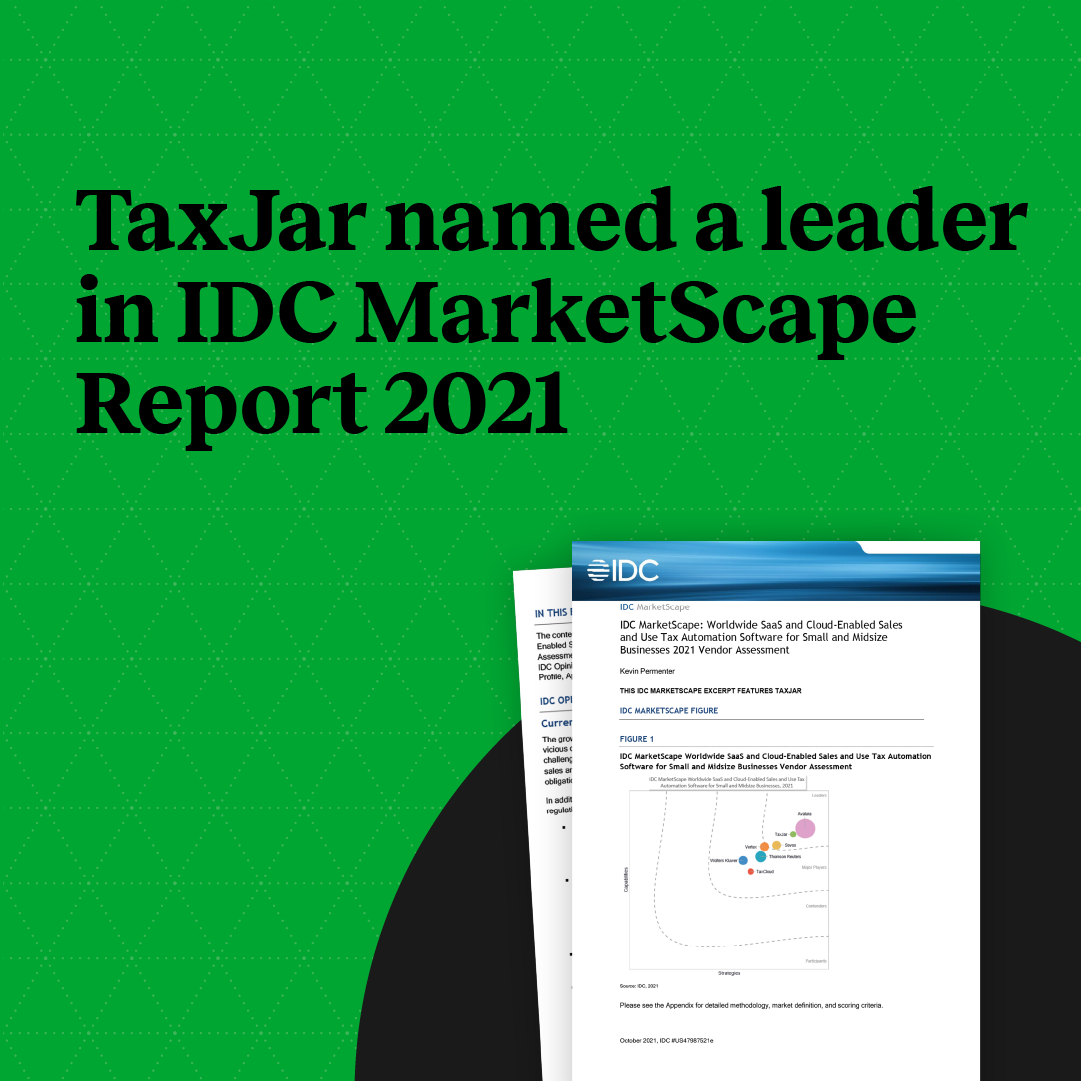

TaxJar Named a Leader in IDC MarketScape: Worldwide SaaS and Cloud-Enabled Sales and Use Tax Automation Software for Small and Midsize Businesses 2021 Vendor Assessment

by October 14, 2021

TaxJar, a SaaS-based sales tax automation platform, has been named a ‘Leader’ in the IDC MarketScape: Worldwide SaaS and Cloud-Enabled Sales and Use Tax Automation Software for Small and Midsize Businesses 2021 Vendor Assessment (Doc #US47987521, October 2021).

The IDC MarketScape report provides an assessment of the SaaS and cloud-enabled sales and use tax automation software for small and midsize businesses and discusses the criteria for companies to consider when selecting a system.

Download an excerpt of the report here.

The report attributes the growth of tax regulation to increasing the complexity of selling products globally. Along with the global pandemic, factors such as marketplace facilitator laws, South Dakota v. Wayfair, shifting jurisdictions and indirect tax rates, and new financial reporting standards have caused a rapid change in tax regulation.

According to the report “While the pandemic was a drag on the global economy in many ways, the pandemic was an accelerator for tax complexity and tax enforcement. As a result, the new reality is shaping up for corporate tax managers where digitization of workflows and business models will accelerate rapidly. The data requirements for tax managers will continue to increase in both variety and velocity.”

With its cloud-native approach, TaxJar’s focus on the customer experience and its large partner ecosystem were key drivers behind us being named to the Leaders category

- Cloud-native technology: TaxJar was built as a cloud-first application, with scale and performance in mind. TaxJar offers modern APIs with 99.99% uptime and automated filing incorporated using both robotic process automation and rule-based automation to handle interactions with state revenue departments.

- Customer focus: TaxJar makes customer support a major priority. TaxJar’s customer service is an integral differentiator. TaxJar achieves this by providing customers with multiple avenues for understanding the nuances of sales tax — from its Sales Tax Blog to its support articles, developer documentation, and online learning courses to manage the complexity of SUT.

- Large partner ecosystem: With integrations built in-house for one-click deployment (and supported with developer documentation) and aggregate reporting across all channels, TaxJar allows its customers to view all transactions across every place they sell (Amazon, eBay, Shopify, custom cart, etc.) in one report. This aggregate reporting also enables customers to track economic nexus across all channels in one single view.

With over 500 (and growing) sales tax rate changes every year, knowing whether or not you’re collecting and remitting the right amount of sales taxes is challenging, especially for small and mid-size businesses.

According to the report, “the heaviest part of the burden from the complex regulations on digital goods and services will fall on the small and mid-size business (SMB) digital commerce retailers where tax management resources (e.g., time, money, and people) are more limited. IDC believes that this burden places a heavy focus on affordable, cloud-based tax compliance software in the coming months, especially among smaller digital retailers.”

“Many tax software vendors have invested a tremendous amount of resources in enhancing/launching products that address the rapid changes in the regulatory landscape over the past year. Such vendors are well position for growth as the taxation landscape as it continues to evolve,” says Kevin Permenter,

The IDC MarketScape recommends considering TaxJar “if you are looking for a software vendor with a focus on customer service and a deep understanding of e-commerce and digital services tax compliance.”

TaxJar works with many growing SMB and mid-market companies, including Curology, Wild Alaskan Company, Quip, Eventbrite, Uncommon Goods, and has processed over 300,000 automated filings for its 20,000+ customers. Over the past year, TaxJar continues to gain momentum in all facets of its business:

- Maintains 99.99% API uptime

- Acquired by Stripe in June 2021

- Expanded tax research content to include 800+ product tax codes

Again, we’re pleased to move to the ‘Leader’ category this year and we’re happy to offer complimentary access to the excerpt for more information.

About the IDC MarketScape:

IDC MarketScape vendor assessment model is designed to provide an overview of the competitive fitness of ICT (information and communications technology) suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. IDC MarketScape provides a clear framework in which the product and service offerings, capabilities and strategies, and current and future market success factors of IT and telecommunications vendors can be meaningfully compared. The framework also provides technology buyers with a 360-degree assessment of the strengths and weaknesses of current and prospective vendors.