Black Friday and sales tax nexus: how to prepare

by September 19, 2025

Black Friday typically marks the beginning of the holiday shopping season. Rumor has it that it’s referred to as “black” Friday since it is when retailers will begin to turn a profit. We aren’t sure if that’s true or not, but there’s no mistaking that Black Friday will bring in a lot of orders for e-commerce retailers.

With an influx in online orders coming, your Black Friday prep list is growing. You’re thinking about inventory, customer support, shipping, your website, the list is long. If your sales tax compliance isn’t at the top of that list, it should be. Here’s why.

Increased number of states where your business now has sales tax liability (i.e. sales tax nexus)

Think about your projected sales and growth. Are you prepared to handle an influx in sales? Do you have the right software in place? Will your increased sales put you into the category of remitting sales tax when you previously weren’t responsible? A busy sales season is every seller’s dream, but it can also bring about a new burden, something called sales tax nexus.

When you have sales tax nexus in a state, you’re required to comply with the sales tax laws of that state. If the Black Friday/Cyber Monday weekend sales will trigger economic nexus in new states for you, you’re not alone. Many businesses will find that the fourth quarter gross sales will push them over the state’s thresholds. This is because most of the laws specifically state that the thresholds are per calendar year or in some cases, the previous calendar year.

The landmark Supreme Court case, Wayfair vs. South Dakota, gave the states the right to set their own thresholds to trigger sales tax responsibility for remote sellers (known as economic nexus). As a result, many e-commerce stores find themselves on the hook for remitting sales tax after a successful holiday season and are left confused on what to do until it’s too late.

If you think you’ll fall into this category of having sales tax nexus in a state, be it physical activity (like a physical office or employees), or economic nexus (revenue or transaction activity that surpasses the state’s declared economic threshold), you’ll want to look at the necessary steps to register for a sales tax permit in each state where you’ll be remitting sales tax. To help with this, we’ve got a handy guide on how to register for a sales tax permit in each state.

Once you’ve identified the states where you’re responsible for remitting sales tax, you’ll begin the registration process to get a tax ID and start collecting sales tax. When it’s time to file with the state (the state tells you what frequency to remit your sales tax reports), you might find yourself overwhelmed if you have nexus in upwards of 30 or 40 states. Each state has different tax filing requirements, so researching these will help reduce frustration as you begin to collect sales tax.

But, if you’re like most people and would rather “set it and forget it,” a sales tax software solution like TaxJar can generate monthly reports and track all your sales across the platforms you use. Even better, our AutoFile program will file your taxes at the right time, to the right state, eliminating any headaches on your end.

Changes in your state-assigned filing frequencies (quarterly → monthly)

Beginning now, many states will be sending notices informing taxpayers of a change in their sales tax filing frequency for the upcoming year.

Why now? Frequency changes occur when your sales volume increases or decreases and triggers a certain state threshold. If your sales increased, you may be required to file more frequently, while if they decreased, you may be notified to file less frequently.

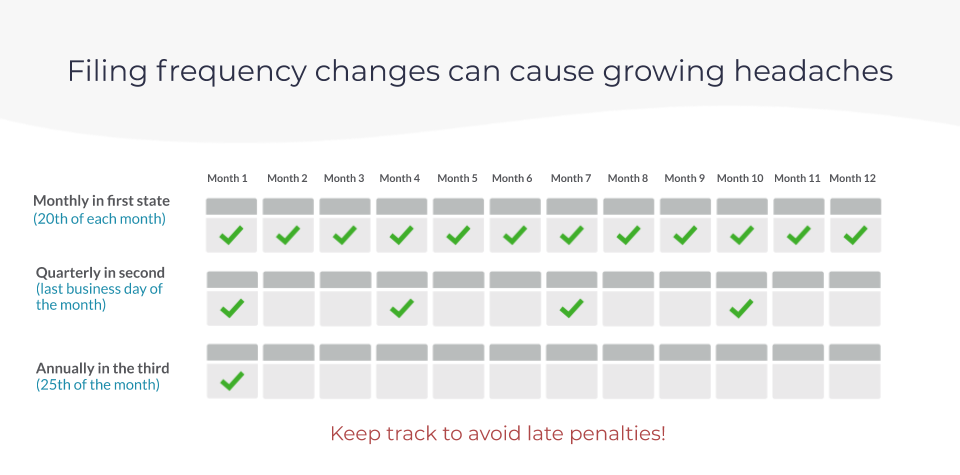

Here’s an example filing scenario for a tax filer who just files in three states. As you can see, it’s a lot to keep track of, and that’s only three states.

Another reason you want to pay on time is that every state has a late fee if you file late. And if you owe past due sales tax, they’ll also tack on interest.

If this all sounds overwhelming, don’t panic. TaxJar AutoFile automatically submits your returns to the states where you’re enrolled and ensures you never miss a due date.

The cost of noncompliance

Back fees and fines from sales tax noncompliance have the potential to crush a growing e-commerce company, so when it comes to sales tax, ignorance is anything but bliss. E-commerce leaders have to stay on top of where they may have sales tax nexus and owe taxes as their businesses grow and sales tax laws across the country change.

Automating your sales tax through a trusted solution increases efficiency and accuracy, but also allows you to focus on growing your business. That’s why we built TaxJar. Our sales tax platform will help you track your nexus requirements and automatically calculate the accurate amount of sales tax for every item, in every state. Get ahead of the Black Friday/Cyber Monday season and start your free, 30-day TaxJar trial today.