The gift and the curse of selling more during the holiday season…

by November 5, 2021

Like a holiday within a holiday, Black Friday / Cyber Monday (BFCM) is an “out with the old, in with the new” inventory purge that helps sellers meet yearly sales targets through deep discounting and promotions. During this time, consumers tend to flock towards higher ticket product categories such as consumer electronics, where the Nintendo Switch, Air Pods, or large televisions seem to be on everyone’s wish lists.

Before the pandemic, shoppers were already gravitating toward online channels during Black Friday and Cyber Monday – in many cases to beat the lines and in-store ‘doorbusters’ traditionally associated with Black Friday. However, from 2020 to 2021, market, health, and economic factors drove a dramatic surge in online shopping.

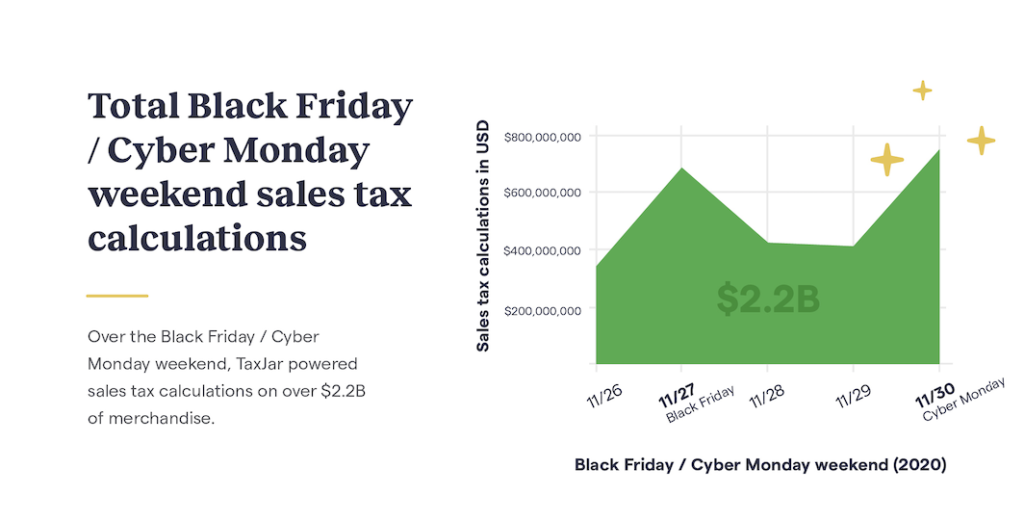

To better understand what happened last year, TaxJar ran an in-depth post-BFCM report that dug into traffic to our sales tax calculations API, the total value of sales tax calculations on orders, sales tax receipts, and order values.

As a follow-up, this blog post offers a preview of what we’re expecting for the 2021 holiday shopping season and the anticipated impact on sales tax compliance.

Will consumers spend more this holiday season?

As we start the holiday countdown, it’s easy to forget how in 2020, many believed Covid and the associated market uncertainty would stifle spending during BFCM. But, as we have seen, the iron-clad resilience of holiday shoppers brought about Cyber Monday spending increases from $9.4 billion in 2019 to $10.8 billion in 2020, making Cyber Monday 2020 the biggest shopping day ever in the U.S. Moreover, according to BlackFriday.com, even as we face supply chain and shipping delays, e-commerce sales are projected to grow $11.8 billion this year.

A similar trend occurred during Black Friday, where the NRF (National Retail Federation) reported the Saturday after Thanksgiving saw significant spikes in online activity in 2020. It was the first time Black Friday shoppers who shopped online breached 100 million, up 8 percent compared to 2019. That same Saturday, the number of shoppers grew 17 percent compared to last year’s numbers, with a 44 percent increase in ‘online-only’ for the entire weekend.

Last year, the TaxJar API also saw a major surge in sales tax calculations on over $2B of merchandise.

Putting things in perspective, the blurred lines between Black Friday and Cyber Monday will continue this year and in years to come. It makes sense if you think about the gradual shift in consumer shopping behaviors.

Traditionally, Cyber Monday captures shopping activity once consumers are back in the office, while Black Friday was more for in-store shopping. Now that shoppers are more comfortable with e-commerce, especially during Black Friday, the distinction between the two shopping periods is less apparent. We’ve also seen Cyber Monday morph into Cyber Week, as promotions start Monday but run at least through Wednesday.

According to Gabrielle Pastorek, Retail Analyst at Finder.com, “We’re definitely seeing Black Friday get stretched longer and longer,” Pastorek says. “It’s almost like the few weeks before Black Friday, and then the few weeks after Cyber Monday are all just being mashed into one big sale.”

Many retailers offer ‘Black Friday-ish’ deals earlier in the shopping season compared to previous years to get ahead of the busy shopping periods. These early-bird deals, which as of late are partially the result of supply chain issues and chip shortages, force retailers to start earlier or extend periods in which they offer discounts. Speaking of the supply chain, it was one of the culprits causing delays in Amazon Prime Day last year, which may be repeated this year.

It’s no surprise that in 2021, Americans will likely spend more in terms of volume and dollar amount. This year, more buying power is partially due to higher consumer savings, the government stimulus, and a tightening labor market that has driven employee wages higher.

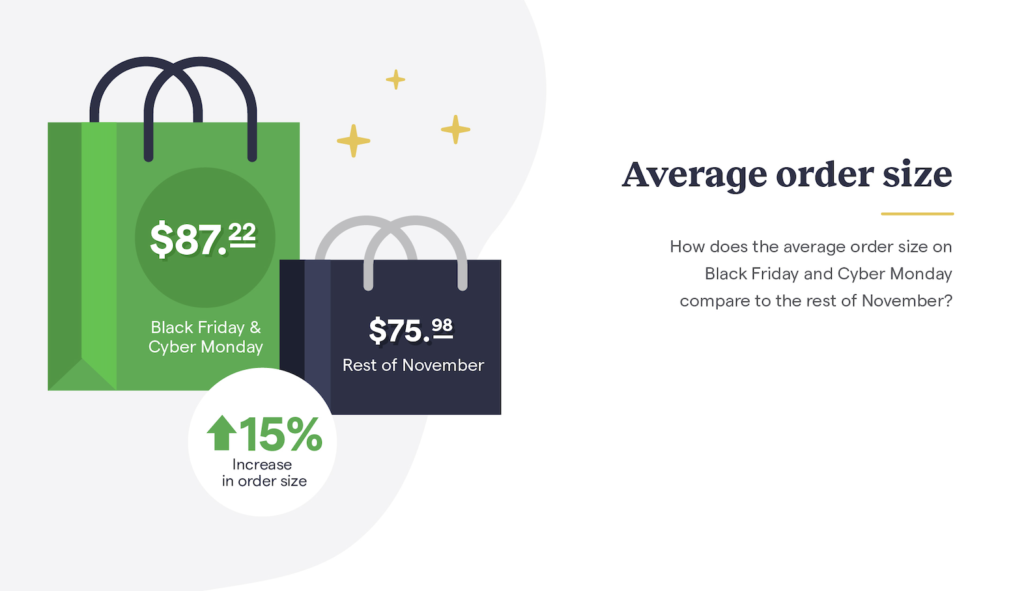

In addition, in last year’s BFCM post, we reported a 15% increase in order size between the rest of November and BFCM, which means consumers are willing to spend more online for higher ticket items compared to previous years.

As per the Future of E-commerce report, retailers, on average, sell through three or more channels, making it easier to reach customers where they’re at to stimulate spending.

How might higher inflation impact BFCM?

According to Adobe, prices for online goods have increased consecutively for 15 months across several product categories. This trend ‘goes against the grain’ as retailers typically reduce prices during BCFM to offload excess merchandise.

“Categories that once had a minor presence in e-commerce are now becoming staples, with unprecedented pricing trends that no longer hold down overall inflation,” Adobe Digital Insights lead analyst Vivek Pandya said. “We are entering new territory.”

As Adobe reports, online prices increased 3.1 percent year over year leading into 2021. Putting things in perspective, online prices fell 3.9 percent annually from 2015 to 2019.

“The bulk of the recent upturn in U.S. inflation has been driven primarily by supply chain bottlenecks and low levels of inventories, but higher labor costs are often passed on to consumers and are considered a precursor of broader inflation,” National Retail Federation chief economist Jack Kleinhenz said.

Adobe also believes Americans will have spent more on the web before November 1 than they have online for all of 2019. Consumers have already spent 58% more during the first eight months of this year compared to the same period in 2019.

Will increasing BF/CM online sales mean greater sales tax liability?

The concept of economic nexus stems from the 2018 South Dakota v. Wayfair Supreme Court decision, where states could require companies to collect sales tax if they breach state-defined sales volume and or revenue thresholds. In basic terms, if you sell more into a state, you may have to collect sales tax on behalf of that state if you meet specific criteria.

Understanding economic nexus is one thing but knowing how to track it is what trips companies up. The rules are set at the state and local level, so as companies expand their e-commerce operations, they’ll have to adhere to an increasingly varied set of laws and requirements. Rules that may not only impact where a company files but how often and at what rates.

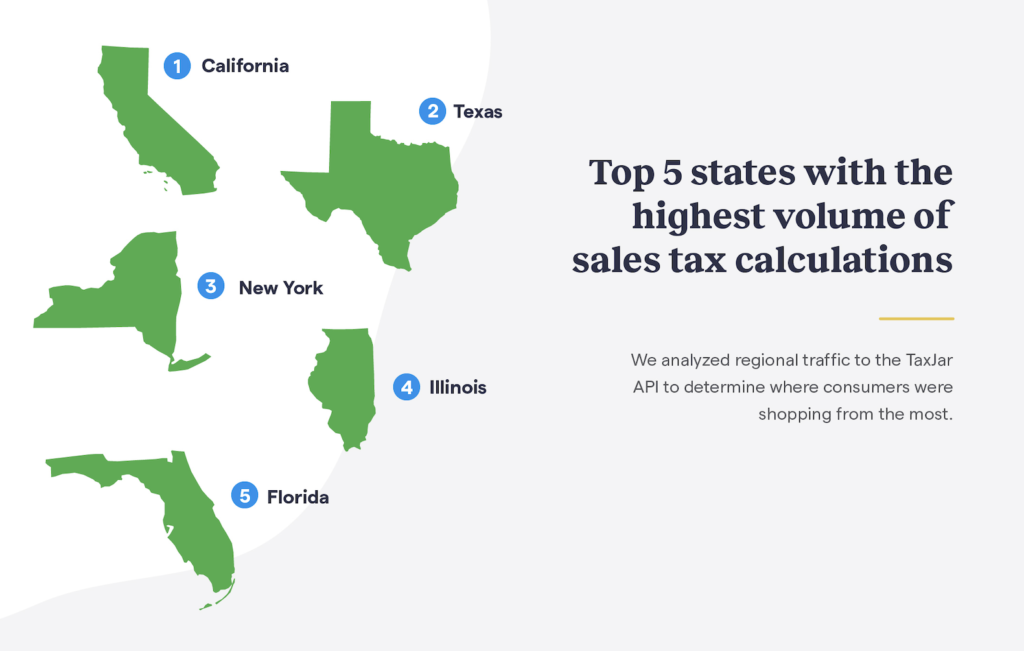

Many companies are also seeing increased transactions in key states, where consumers are ramping up spending. Through the TaxJar API we were able to identify the top states with the highest volume of sales calculations.

According to, The Future of Sales Tax Compliance report, a quarter of companies who play in the e-commerce space sell to all 50 states, with most companies selling to an average of 25 states. Although the rules around economic nexus generally pertain to sales volume and/or revenue generated, most companies still need to align their understanding and recognition of nexus with a growing number of states.

For instance, a seller who sells in California would trigger economic nexus after breaching $500,000/year in gross revenue on the previous or current calendar year’s sales. In contrast, an Illinois seller activates economic nexus after reaching $100,000/year in gross revenue or makes sales into Illinois in more than 200 separate transactions in the previous twelve months.

States may enforce more frequent remittances (e.g. from quarterly to monthly) as a company sells more, so it’s essential to be on the lookout for any notices from the state regarding filing frequency changes.

Not surprisingly, financial professionals ranked state registrations as their top sales tax compliance issue. As one financial professional described, “Sales and use tax issues are particularly tough if a firm operates in several states, in addition to the usual issues of complying with different laws.”

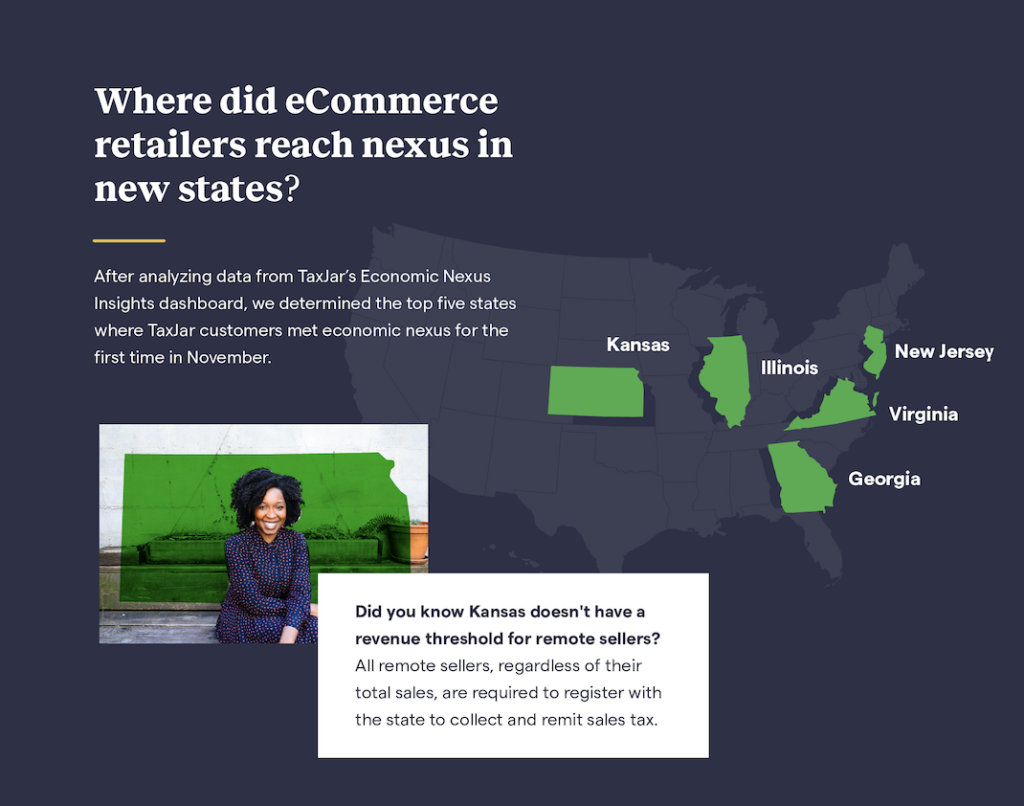

Enacting an economic nexus tracking and compliance plan is challenging even for the most prudent finance teams, especially if state or local jurisdictions changed sales tax without them knowing. However, of the 500 respondents surveyed for the report, 92% think it’s vital that compliance software stays updated with tax obligations for each state and jurisdiction.To further illustrate, last November, our Economic Nexus Insights dashboard identified five key states where our customers reached economic nexus for the first time (Kansas, Illinois, New Jersey, Virginia, and Georgia). Merchants likely reached nexus in these states because more consumers adopted online shopping during the pandemic.

So what should you do now?

If you find yourself in a position where you may or may not have prepared for the impact of BFCM on sales tax compliance, you can do a few things to get caught up.

Perform a Nexus Study

A Nexus Study helps you identify in which states you have economic nexus and for how long. In addition, the study enables you to determine what you may owe in sales tax. A good starting point is TaxJar’s Economic Insights Tool, your finance team, or external sales tax experts.

Determine Your Past Due Sales Tax Liability

As you nail down where you have economic nexus, the next step is to determine how much you should have collected on behalf of the states. To help, TaxJar has an Expected Sales Tax Due report that shows you how much sales tax you should have been collecting. A similar report could be produced in-house or via external sales tax experts.

File a Voluntary Disclosure Agreement

In cases where you have low sales volume in a state, it may make sense to directly pay the state for sales taxes you have not collected. However, if the amount is significant, you can file a Voluntary Disclosure Agreement (VDA) – we recommend conferring with a sales tax expert either in-house or external to your company. In this case, a sales tax expert can negotiate the issue on your behalf, which may drive down costs and reduce your exposure to penalties and fees.

Overall, sales growth during BFCM is a good thing for most businesses. The key is to understand how increased sales volume or revenue generated in new states impact what you owe and where. If you prepare for it, the holiday shopping season should be a gift that keeps on giving for both you and your customers.