When (and when not) to cancel a sales tax permit

by January 19, 2025

Sometimes it seems natural and obvious to a business that they no longer need a sales tax permit in a state and can cancel an active sales tax registration.

However, just as with everything else sales tax related, states can sometimes throw a wrench into the works when it comes to canceling sales tax registration.

This post will go over the common reasons to cancel a sales tax permit, some common ways states may challenge you on this, and what to do if you have questions about cancelling a sales tax registration.

Need help registering for a sales tax permit? TaxJar can handle the registration process for you. Visit our registration page to request our team of experts manage your sales tax registration on your behalf.

Reasons for canceling your sales tax registration

In most cases, the need to cancel a sales tax registration arises when the reason for the original registration no longer exists. Here are a few reasons businesses cancel their sales tax registrations:

- The businesses closes (or passes to new ownership)

- The business no longer has sales tax nexus in a state

- The state now has a Marketplace Facilitator Law and allows marketplace sellers with no other sales activity in the state to cancel sales tax permits

As obvious it may be that your business no longer has a sales tax obligation in a state, the state that has issued the registration you want to cancel may not see it that way. Your company’s registration and sales tax compliance with the state is a source of revenue with the state and they want to hold onto that revenue for as long as possible. Despite the state’s desire to keep your company registered, that should not deter you from canceling your registration if you meet the state’s requirements.

Let’s dig in a little deeper to each of these reasons for cancelling sales tax permits and any potential pitfalls your business may face.

You sell or close the business

One common reason to cancel a registration, and one that can’t be opposed by the state of registration, would be the sale or closing of your business so that your company will not derive any revenue from customers in their state. In a similar light, if your business will no longer have customers in the state and there is no long-term prospect that new customers will be obtained in that state, then canceling your registration is completely appropriate. If you acquire customers in the future and have the requisite nexus in the state then your company’s registration can be reactivated.

Over the years I have seen companies attempt to cancel their tax registration immediately after their company stops having nexus in the state. While the may be appropriate from your perspective, the state where you are registered has a significant vested interest in keeping your company registered for as long as they can to collect tax receipts on taxable sales to customers in that state.

According to sales tax expert Ned Lenhart of Interstate Tax Strategies, P.C., if you are a wholesaler and have not remitted sales tax to the state in the past, then canceling your registration or filing a “final return” may be the most appropriate action to take if the nexus creating activities stop in that state.

You no longer have nexus in the state

If your company makes taxable sales and is currently collecting and remitting sales tax to the state and the nexus creating activity has just stopped, the states may invoke the concept of “trailing” or “residual” nexus which may require that tax be collected and returns filed for 6 months or longer before they will accept your cancellation permit. The states will to assert this position by arguing that the sales activity or the other nexus creating activities your business had in the states has established a market place for your product in their state will continue to generate sales even after these nexus creating activities have stopped. Existing customers may continue to buy products or new customers may be acquired based on historic nexus creating actions.

In some cases, the concept of trailing nexus may arise during an audit rather than immediately after you have filed your final return or submitted a registration cancellation. In those situations, the states may assess sales tax on untaxed sales for a period of time after your final return was filed and assert this the historical sales activities conducted by your company continued to create revenue for your company even after they stopped. If your company’s nexus creating activity in a state was the presence of an employee who had no nothing to do with soliciting sales then the concept of residual or trailing nexus may not apply.

Be aware of economic nexus

Up until 2018, “sales tax nexus” generally meant some sort of physical connection to a state. A business needed to have an employee or contractor, office or other physical location, or inventory stored in a state to be considered responsible to collect sales tax from buyers in that state.

But the South Dakota v. Wayfair Supreme Court decision changed all that. Now, states are constitutionally allowed to pass laws stating that economic activity in a state creates sales tax nexus.

Long story short, each state is allowed to set an economic threshold that means a business is required to collect sales tax from buyers in that state. This threshold is generally around $100,000 in sales per year in a state or 200 transactions to buyers in a state, but it varies by state. Read about economic nexus, and see the economic nexus thresholds for each state here.

This means that while you may find that you no longer have a physical presence in a state, you may still be required to collect sales tax from buyers in that state.

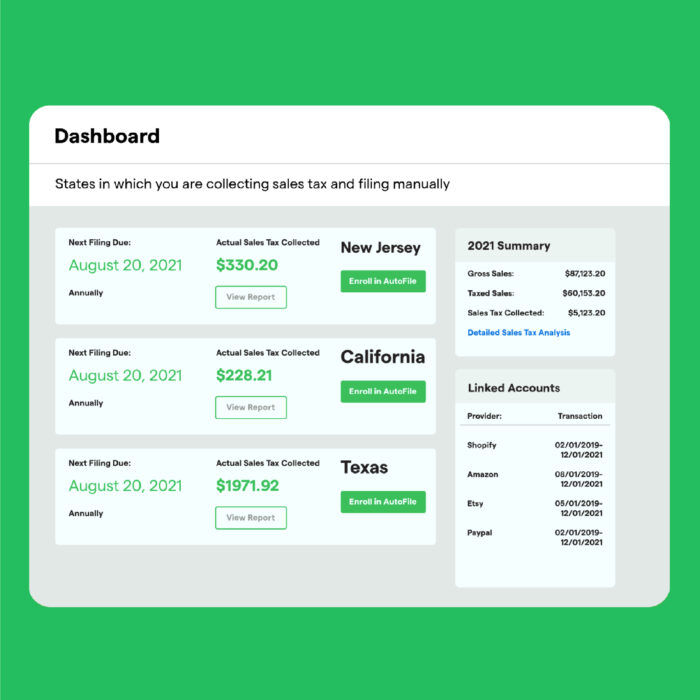

TaxJar has a handy tool to help you determine if your business has, or is approaching, those economic nexus thresholds in each state.

Find out here if your business has economic nexus.

The state has a marketplace facilitator law

At TaxJar, we get many questions from businesses who sell on online marketplaces regarding whether they can now cancel their sales tax permits if a state where they are currently registered has a marketplace facilitator law.

Quick recap: Marketplace facilitator laws require that online marketplaces like Amazon, Walmart, eBay, or Etsy collect sales tax on behalf of 3rd party sellers who use the platform. Nearly every state now has a marketplace facilitator law.

However, use caution before cancelling your sales tax permit in a state with a marketplace facilitator law, for these reasons:

- Your business makes non-marketplace sales – Marketplace facilitator laws only apply to marketplaces. If you have sales tax nexus in a state and make other sales in that state, you are still required to collect sales tax from buyers in that state. For example, if your business sells on Amazon but also through your own online store built on Magento, you are required to collect sales tax from your non-marketplace buyers.

- Your state still requires that 3rd party marketplace sellers maintain sales tax registration – Some states allow marketplace sellers with nexus in states with marketplace facilitator laws to cancel their sales tax permits. However, many states do not. They still want online sellers with nexus in the state to file periodic sales tax returns, even they are only informational returns. It is vital that, if you are planning to cancel a sales tax permit, you check with the state to ensure they do not require you to remain registered and file informational returns.

Reasons not to cancel your sales tax registration

Keep in mind that, when cancelling sales tax permits, you not only have to cancel with the state, but you also have to disable sales tax collection on all of your existing sales channels.

For that reason, we always recommend looking ahead before you cancel your sales tax permit. This will help you avoid cancelling your sales tax permit and then being required to go through the trouble of registering for a new sales tax permit, and reenabling sales tax collection on all of your sales channels, shortly afterward.

If your business is in a growth stage, you might want to press pause on cancelling your sales tax permit. Here are a few examples of reasons why:

- You cancel your sales tax permit in a state where you no longer have physical presence, then introduce your new best selling product. Those astronomical sales give you economic nexus in that same state, and you are required to register for a new sales tax permit

- You cancel your business’s Florida sales tax permit, then hire a remote employee in Florida and are required to register for a new sales tax permit

- You sell on Amazon and through your own Shopify store. You cancel your sales tax registration, but then Amazon opens up a fulfillment center in that state, giving you renewed nexus there

How to cancel your sales tax permit

Companies currently filing sales tax returns in numerous states should periodically determine if the need to continue to file those returns still exists. Businesses change over time which can expand or contract the need to file sales tax returns in particular states.

In most cases, filing a “final” sales tax return is all that is required to accomplish this act. Some states have additional forms that must be completed to cancel a registration or they may send a questionnaire after they receive your cancellation request.

As noted above, there are many legitimate and noncontroversial reasons for canceling your sale tax registration number. However, because your company is the remittance conduit for tax collections due to the state government, they may not be too quick to approve your cancellation request if they believe that nexus exists or that there are trailing or residual nexus issues. Registration cancellations are essential to streamlining your sales tax compliance, but the final decision as to your registration status is made by the state department of revenue not by your business.

If you have any reason to worry that cancelling your sales tax permit will result in penalties from a state, we recommend consulting with a vetted sales tax expert.

Need help registering for a sales tax permit? TaxJar can handle the registration process for you. Visit our registration page to request our team of experts manage your sales tax registration on your behalf.

Ready to automate sales tax? Sign up for a free trial of TaxJar today.