Is shipping taxable in Colorado?

by February 13, 2025

Sales tax can be tricky, especially because each state has a unique set of regulations. A frequently asked question is whether or not to charge sales tax on shipping and handling. Let’s see how Colorado handles this issue for businesses.

Is shipping taxable in Colorado?

Here is what the Colorado Department of Revenue has to say:

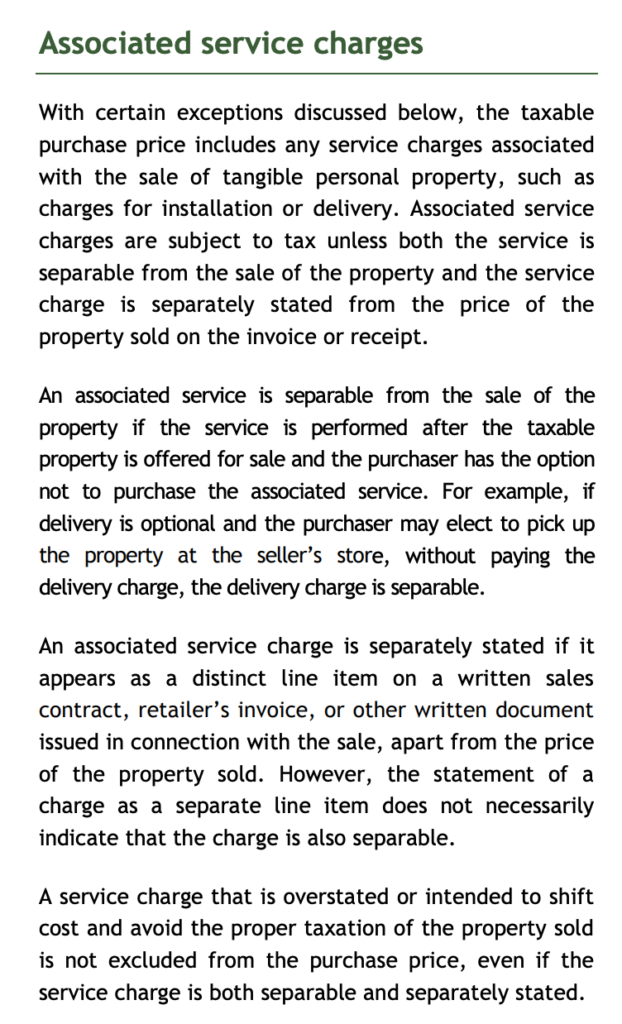

So it appears that in Colorado, generally, shipping and handling is not taxable as long as you meet two criteria:

- The shipping and handling charges are separable from the purchase. These shipping and handling charges are considered separable if the person selling allows the buyer to use the seller’s transportation service or an alternative transportation service, which includes the buyer coming to get the goods themselves.

- The shipping and handling charges are listed separately on the invoice.

It also reads that there is no sales tax on shipping related to tax exempt sales, including tax exempt items, sales to a tax exempt charity, or shipping out of state because the delivery charges are considered part of the exempt sales.

That said, if your business sells online, chances are you do not meet criteria #1 because the shipping isn’t “separable” from the transaction. For example, if a customer can’t come to your showroom and pick up the item then the act of shipping the item was necessary to the sales and Colorado considers that taxable.

Sales tax on shipping in Colorado

If you sell products online to buyers in Colorado, you can avoid charging sales tax on shipping in Colorado if you do these two things:

- List the shipping charges separately on the invoice.

- Make sure the shipping and handling charges are separable by allowing the buyer to use the seller’s transportation service or an alternative transportation service, which includes the buyer coming to get the goods themselves.

Handling Colorado shipping and handling sales tax with TaxJar

The TaxJar app defaults to the most common Colorado scenario – that shipping and handling is non-taxable.

However, if your business does charge sales tax on shipping, then TaxJar’s Shipping & Handling Override allows you to update that in your state tax settings. This will make the Colorado Expected Sales Tax Due Report more accurate. This will also tell the TaxJar API to charge sales tax on Colorado shipping.

Learn more about how TaxJar treats shipping and handling here.

To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.