Streamlined Sales Tax (SST): Benefits and potential risks to consider

by August 29, 2025

For e-commerce business owners, the phrase “sales tax compliance” can trigger a headache. Managing your obligations across dozens of states—each with its own unique rates, rules, and product definitions—is a challenging task that pulls you away from what you do best: growing your business.

To help alleviate some of this complexity, a group of state governments introduced a solution: the Streamlined Sales Tax (SST) program.

While the SST program offers powerful benefits, it also comes with significant risks and trade-offs that can create new burdens for your business. This article will provide a balanced overview of the pros and cons to help you decide if enrolling is the right strategic move.

What is the SST program?

The SST program is an agreement between 24 member states to make sales tax administration simpler and more uniform. The main goal is to reduce the burden of sales tax compliance on businesses, especially remote sellers.

To achieve this, the SST Governing Board certifies third-party software companies as Certified Service Providers (CSPs). These CSPs integrate with e-commerce platforms and handle the major task involved in sales tax compliance on behalf of businesses.

Key features of the SST program’s standardization include:

- Uniform definitions for thousands of products and services

- Simplified tax rate structures

- Centralized tax returns and remittance processes

- Standardized audit procedures

Arkansas

Georgia

Indiana

Iowa

Kansas

Kentucky

Michigan

Minnesota

Nebraska

Nevada

New Jersey

North Carolina

North Dakota

Ohio

Oklahoma

Rhode Island

South Dakota

Utah

Vermont

Washington

West Virginia

Wisconsin

Wyoming

Tennessee is an Associate Member State.

The Pros: Key benefits of joining the SST program

Enrolling in the SST program through a CSP offers several compelling advantages:

1. Simplified (and centralized) registration: Instead of navigating the registration process for 24 different states, you can use the Streamlined Sales Tax Registration System (SSTRS). This allows you to fill out a single application to receive a sales tax permit in all 24 member states at once, saving significant administrative time.

2. Free sales tax compliance (for volunteer sellers): For businesses that don’t have physical nexus in an SST state and enroll as a “volunteer seller,” a CSP will calculate, collect, and remit your sales tax at no direct cost to you. The states pay the CSP for their services, making it a very attractive option for businesses on a tight budget.

3. Significant audit protection: When you use a CSP and provide them with the correct information, you are granted liability relief from audit penalties related to incorrect tax calculations. If your CSP makes a mistake in calculating the tax, the responsibility falls on them or the state—not on your business.

The Cons: Potential risks and hidden drawbacks

The benefits of SST are clear, but they come with critical trade-offs that can have serious financial and administrative consequences:

1. Registration is an “all-or-nothing” commitment: This is the most important potential risk to understand. When you use the SSTRS to register, you are automatically registered in ALL 24 member states. This creates filing obligations for your business in every single one of them, regardless of whether you’ve made a single sale there. You are now legally required to collect sales tax and file a return in all 24 states, even those with zero sales, which can create a massive and unnecessary filing burden.

2. Loss of vendor discounts: Many states offer a discount, typically 1-2% of the sales tax collected, to businesses as a “thank you” for filing on time. This is often called a vendor discount or filer’s credit. When a CSP files for you through the SST program, the CSP or the state keeps this discount. While it may seem small on a single return, this lost revenue can add up to thousands of dollars over time—money that could have gone back into your business.

3. Reduced flexibility and control: By using a CSP through the SST program, you are handing over a critical financial function to a third party. Similar to a Merchant of Record (MoR) relationship, this can lead to a loss of direct control over your filing process and financial data, tying your compliance schedule to the CSP’s systems.

4. Complexity still exists outside of SST: The SST program only covers its 24 member states. You still have to manage compliance on your own for all non-member states. This can create a fragmented compliance strategy where you use a CSP for one set of states and another solution for the rest.

The TaxJar position: Why we prioritize your bottom line

At TaxJar, our sales tax engine is fully equipped to handle the complex calculations and product taxability rules for all 46 states with a state sales tax, including the 24 SST member states. On top of our filing capabilities, we can register for a sales tax permit on behalf of our customers in all 46 states.

However, we have made a deliberate choice not to participate as a Certified Service Provider (CSP) or file through the SST program. The reason is simple: We believe the vendor discount belongs to you, the business owner, and you deserve to keep the filer’s credit you are entitled to.

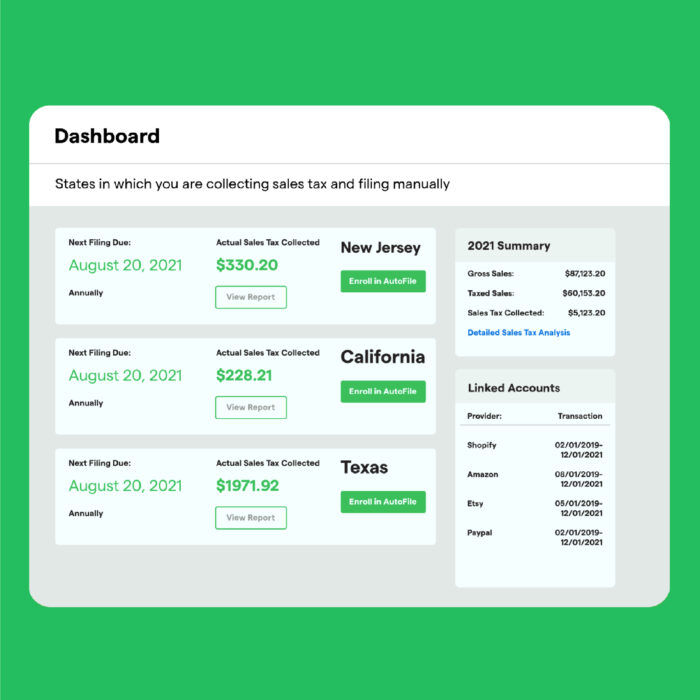

Our AutoFile service files directly with each state, ensuring that our customers receive any and all vendor discounts they have earned. We built our automation to protect our customers’ revenue, not take away from it.

Is SST the right choice for your business?

The decision to join the SST program comes down to a clear tradeoff: simplicity and robust audit protection in exchange for mandatory registration in all 24 member states and the loss of all vendor discounts.

SST might be a good fit for:

- Large businesses that already have nexus in most or all of the 24 SST states.

- Businesses whose highest priority is mitigating audit risk, regardless of other costs.

SST might not be a good fit for:

- A business with nexus in only a handful of the SST states–the added filing burden will likely outweigh the benefits.

- A business that wants to claim its rightful vendor discounts and maximize its bottom line.

- A business that prefers a single, unified compliance solution for all US states.

Before you enroll, carefully evaluate where you currently have economic nexus and your business priorities. For many, a flexible, comprehensive solution that provides automation with control is the right path to scaling without sacrificing revenue.

Want to see if TaxJar is the right fit for your business? Sign up for a free trial today or speak to our sales team to learn more.