Ultimate guide to sales tax nexus laws

by September 29, 2025

For e-commerce retailers, understanding sales tax nexus laws isn’t just a matter of compliance—it’s a critical component of financial strategy and risk management. As online sales continue to soar, projected to hit $8.1 trillion in 2026, the web of state-specific rules defining your tax obligations becomes increasingly tangled.

From physical presence and economic thresholds to the nuances of product taxability, the landscape is constantly shifting, largely shaped by the landmark South Dakota v. Wayfair Supreme Court decision from seven years ago. Failing to keep pace can expose your business to significant penalties and audit risks.

We’ve created this guide to cut through the complexity, offering a comprehensive roadmap to navigating sales tax nexus laws so you can mitigate risks, ensure compliance, and streamline your operations with confidence.

What sales tax nexus means today

Sales tax nexus occurs when your business has some kind of connection to a state. All states have slightly different definitions of nexus, but they generally consider that a “physical presence” or “economic connection” establishes nexus.

Physical and economic nexus

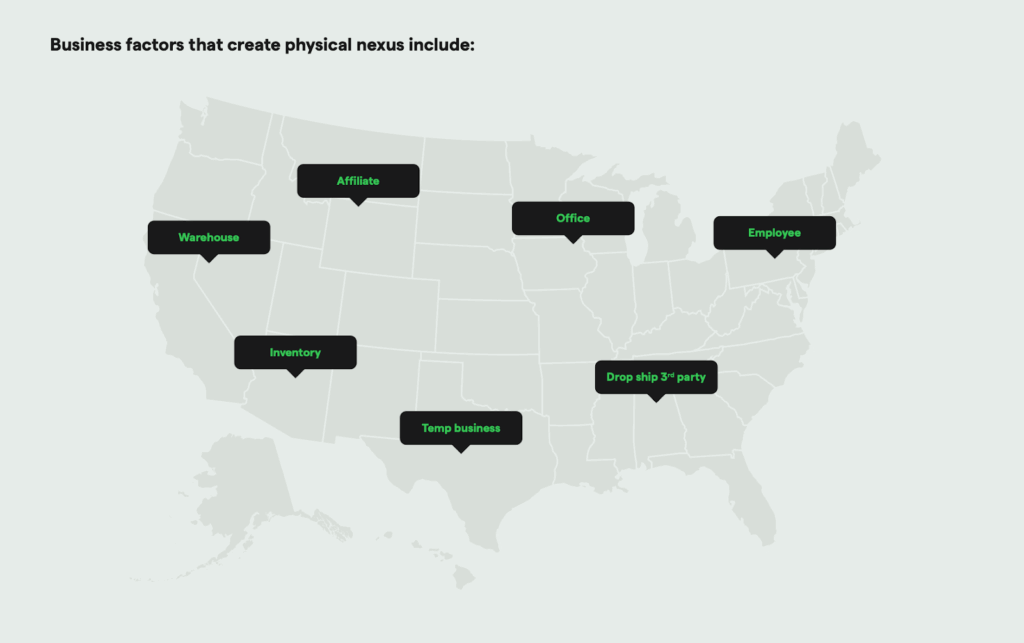

There are two main types of sales tax nexus: physical and economic. Physical nexus includes any business activities that involve you or your business having a physical presence in a state. These include activities like:

- Having an office, store or other location in a state (even a home office)

- Having an employee, salesperson, contractor, etc. reside in a state

- Owning a warehouse or storage facility in a state

- Storing inventory in a state (such as in an Amazon FBA warehouses or other 3rd party fulfillment centers)

- Temporarily doing physical business in a state for a limited amount of time, such as at a trade show or craft fair

The other type of nexus is economic nexus. This is based on different revenue or sales thresholds, with certain states requiring sellers meet both a revenue and transaction threshold, and some states only requiring one threshold to be met. Each state sets their own thresholds.

Don’t forget about product taxability

In the US, most “tangible personal property” is taxable. In other words, most items like furniture, jewelry, toothbrushes, coffee mugs, etc. will be subject to sales tax.

However, some items considered to be “necessities” may not be taxable in all states.

Here’s a list of common item types that may not be taxable in some states:

- Grocery food

- Clothing

- Certain books (textbooks, religious books, etc.)

- Prescription and nonprescription medicine

- Supplements

- Magazines and subscriptions

- Digital products (books, music, movies, etc.)

This is not a complete list, so keep in mind that some states may exempt other types of items. For example, SaaS and digital goods taxability varies significantly across states, with certain states even taxing these offerings differently if it’s used for personal or business use.

How to determine nexus across states

Nexus thresholds vary per state and may change as states update nexus laws. For example, many states have recently made changes to remove transaction thresholds from economic nexus requirements.

Indicators of physical presence include inventory and staff

Physical nexus can be triggered by inventory storage, remote staff, in-person events, and property ownership. Third-party logistics (3PL) and FBA scenarios are significant factors—these should be closely examined when considering programs like Fulfillment by Amazon.

Economic nexus thresholds and how states count sales

Sales tax is governed at the state level, so each state sets their own economic nexus threshold.

For example, in Illinois a business that has grossed over $100,000 in sales in the previous twelve months or made more than 200 sales to buyers in Illinois in the previous twelve months has economic nexus and is required to comply with sales tax laws. While in California, businesses that gross more than $500,000 in sales in a calendar year are required to collect sales tax from customers in the state.

To determine if you have physical or economic nexus, ask yourself these questions:

1. Do I have a location, warehouse or other physical presence in a state?

2. Do I have an employee, contractor, sales person, installer or other person working for me in a state?

3. Do I have products stored in a state?

4. Do I cross state lines to sell my products at a tradeshow, craft fair or other event?

5. Do I have qualifying sales or transactions that exceed the state’s economic nexus threshold?

If you answered yes to any of these questions, explore where you have sales tax responsibilities by learning about each state’s sales tax nexus laws. Remember: collect sales tax from all buyers in the states where you have sales tax nexus. (Unless a marketplace collects on your behalf.)

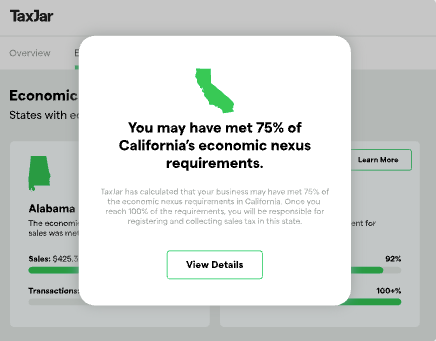

Nexus is slightly different in every state, so check with the state or a sales tax expert if you are not sure whether you have nexus, or sign up for a free TaxJar trial and take advantage of our nexus insights tool. TaxJar’s nexus insight tool simplifies the process with an easy-to-use dashboard and notification system that helps you monitor your nexus exposure as you transact more sales online and across more states. Our dashboard warns you when you may need to register in a new state.

What to do once you hit a nexus threshold

Once you’ve determined you have a sales tax obligation in a state, the next step is to register for a sales tax permit. Each state’s taxing authority handles sales tax registration. You can register for a sales tax permit yourself or let TaxJar register for a sales tax permit on your behalf. You must have a valid sales tax permit before you can collect sales tax, so don’t skip this step!

Most states consider that you have nexus in their state as soon as you engage in nexus creating activities (including storing inventory) in their state.

If you sell via FBA, you can determine the date Amazon first stored your inventory in the state by viewing your Amazon Inventory Event Detail reports.

If you’re in the process of registering for a sales tax license and you need to determine your nexus start date, we would recommend making this decision alongside your CPA or tax consultant.

Like most things sales tax related, it depends on the state. We outline which sales count towards nexus thresholds in each state in this guide.

How to automate sales tax compliance

Keeping up with sales tax nexus laws is a full-time job. Between maintaining transaction and sales counts for your business, as well as staying up to date on the different state threshold amounts and rules, it’s no wonder many businesses choose to automate nexus management for their business with companies like TaxJar.

TaxJar’s Nexus Insights Dashboard makes it easy to see which states require you to collect sales tax based on your economic activity without having to rely on manual workflows. Our dashboard looks at all eligible sales to determine if your sales met any of these thresholds. Sales not included in a state’s threshold count are subtracted, so you know your economic nexus monitoring is accurate.

TaxJar simplifies the process with an easy-to-use dashboard and notification system that helps you monitor your nexus exposure as you transact more sales online and across more states. Our dashboard alerts you when you may need to register in a new state. Ready to get started? Start your free 30-day TaxJar trial today, or reach out to our sales team if you have any questions.