Now you can Automate Your Squarespace Sales Tax with TaxJar

by January 30, 2018

We are thrilled to announce that TaxJar is now Squarespace’s first and only sales tax reporting & filing solution.

Squarespace users on the Commerce Advanced plan can automatically import your Squarespace orders into TaxJar Reports to manually file your sales tax returns. Or enroll in TaxJar AutoFile to automatically file your sales tax returns and never worry about sales tax. Ever.

Automate your Squarespace Sales Tax in Less than 5 Minutes

Connecting your Squarespace store to TaxJar is simple.

- Login to your TaxJar account (Don’t have a TaxJar account? Sign up for a 30-day no-risk free trial and take TaxJar for a spin.)

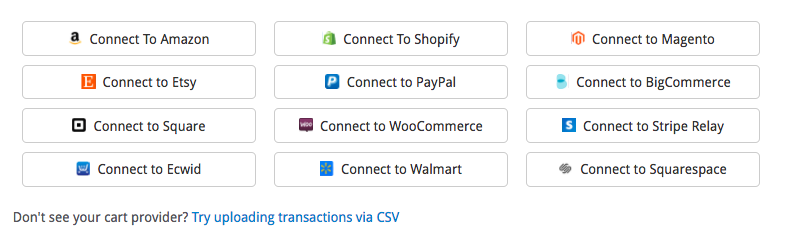

- Click “Manage Linked Accounts” on your dashboard. On the next page, choose “Squarespace.” (Note: Only Squarespace users on the Commerce Advanced plan can connect with TaxJar this way. We do not have an integration to connect Squarespace Basic Accounts to TaxJar, but you can import sales from Squarespace Basic accounts using a CSV.)

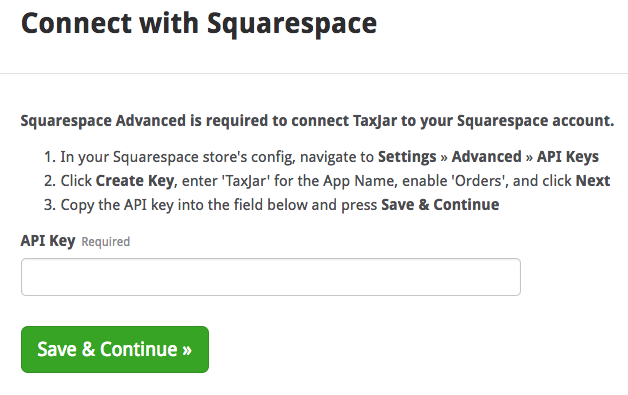

3. From here, TaxJar will walk you through logging in to your Squarespace account and entering your unique Squarespace credentials. Follow the instructions below:

After that, you’re all set! TaxJar will pull in your Squarespace account info and create your return ready sales tax reports.

File Your Squarespace Sales Tax Returns the Easy Way

Squarespace’s sales tax feature allows you to collect sales tax from your buyers, but after that it’s up to you to remit that sales tax back to the state.

That’s where TaxJar has your back.

TaxJar Reports connects with Squarespace and the other shopping carts and marketplaces where you sell your products.

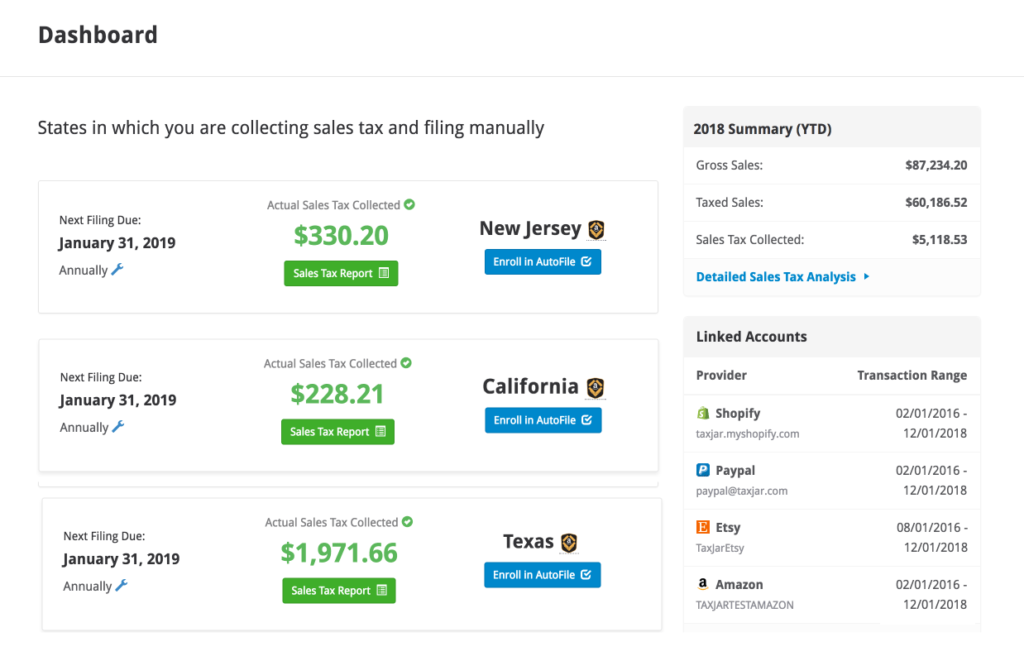

After you’ve connected all of your eCommerce accounts, we’ll we break down all the sales tax you’ve collected. In your TaxJar State Reports, you’ll see not only what you’ve collected in each state, but what you’ve collected in each county, city and other special taxing district – just the way your state wants to see it on your sales tax filing.

Use this information to login to your state’s website and file your sales tax return. (Don’t want to bother with filing? Enroll in TaxJar AutoFile and we’ll file your sales tax returns for you!)

All the states where you collect sales tax are easy to find on your TaxJar dashboard:

To file your sales tax return using TaxJar Reports, just click into a state. Here’s a sample TaxJar state sales tax report for the state of Washington:

TaxJar Reports starts at just $19/month. You can see all of TaxJar’s pricing here.

AutoFile Your Sales Tax Returns

Never want to file another sales tax return? Then enroll in TaxJar AutoFile.

TaxJar will use the info you’ve provided from Squarespace and the other shopping carts and marketplaces you sell on to file your sales tax returns on your behalf.

All you have to do is enroll one time and we’ll take care of the rest. Never worry about missing sales tax deadlines, and never file another sales tax return on your own!

AutoFile costs an additional fee per filing.